My Swing Trades

I’ve taken it easy the past few trading sessions, as I used the time away from the market to re-energize and refocus my efforts on closing out 2019 on a positive note. With that said, the market continues to show a strong bias to the upside, and I will continue to trade in that direction. I am positioned to the long side as well, with the exception of a small position of puts in Canopy Growth (CGC), which hasn’t done much for me at the moment. I will look to ride my current crop of positions tomorrow, and will consider maybe one additional long position.

Indicators

- Volatility Index (VIX) – A much needed bounce, that came with Friday’s half day of weakness. A 7.4% bounce to 12.62.

- T2108 (% of stocks trading above their 40-day moving average): Chart is not printing a correct reading, so I’ll skip this chart today.

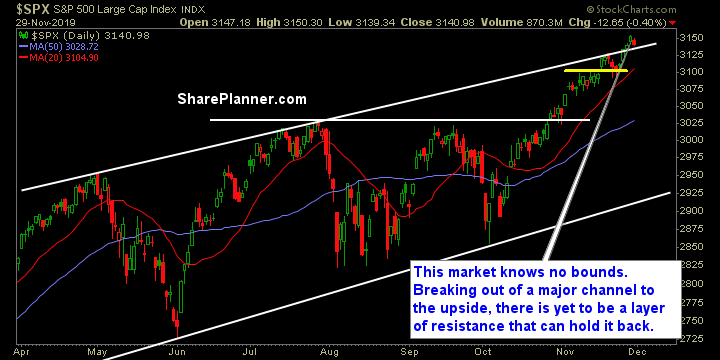

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Every sector was lower yesterday, even though it was the safe sectors that showed relative strength. Energy – I can’t stress this enough – stay away from the sector. Absolutely manic in its price action. I like Friday’s pullback in the Financials to the 5-day moving average. It looks ready to pop. Same can be said about Technology and Discretionary while I would stay away from telecom as continues to decline for a fourth straight week.

My Market Sentiment

I think Friday was a much needed pullback. The market continues to run hot, but as long as the Fed continues QE, this market should keep marching higher. Over the years, the first day of the month tends to have bigger price moves than the rest of the month and we are setting up to see the same again today.

- 4 Long Positions, 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.