My Swing Trades

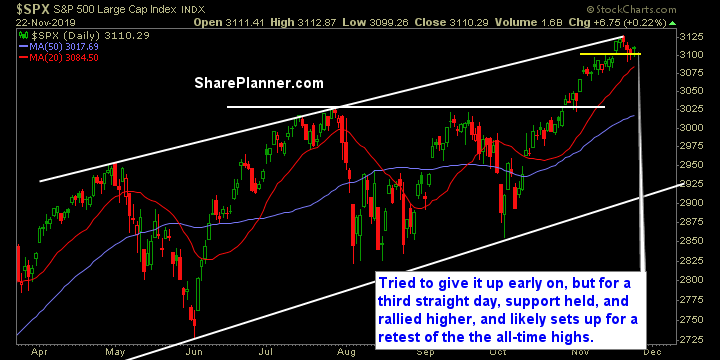

I made a quick day-trade in Pure Storage (PSTG) on Friday for a quick +1.8% profit, while adding two new swing-trade long positions to the portfolio. I’m leaning slightly bullish here, and may even add more long exposure from the Tech sector tomorrow. The market looks primed to retest its all-time highs this week, and it comes during one of the more bullish trading weeks of the year (though don’t tell 2018 that!).

Indicators

- Volatility Index (VIX) – Dropped another 6%. Volatility is currently gone from this market. Until you see some volume flow into this market, there won’t be a sell-off in equities.

- T2108 (% of stocks trading above their 40-day moving average): A 4% spike on Friday, but still very weak with a reading of only 54%.

- Moving averages (SPX): Back above the 10-day moving average but unable to break through the 5-day MA.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Energy remains a very difficult sector to predict, with manic like tendencies that sees price vacillate at extremes. Safe sectors continue to be avoided as a whole by investors, and Financials and Industrials are looking to resume their uptrend of late. Discretionary may look to take anther stab at breaking through long-term resistance.

My Market Sentiment

The pullback to short-term support over a three day period, appears to be holding and likely ready to retest the all-time highs during what has become one of the most bullish trading weeks of the year. While last year saw the S&P 500 decline by over 100 points during Turkey week, I don’t expect anything close to that as the market was in a complete free fall heading into the week. This year, it is sitting a smidge below all-time highs.

- 2 Long Positions, 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.