My Swing Trades

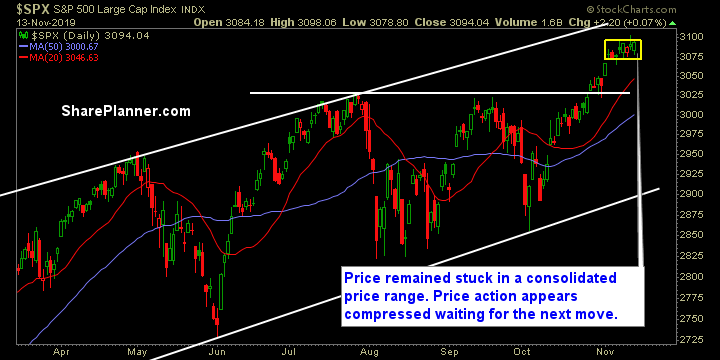

I added one new trade to the long side, while keeping my sole short position in the portfolio, and also dumping NUE for a -1% loss, soon after the open. With the market still buying the dips at every turn, but only enough to get the market back to break even, it makes it hard to be overly bearish, and while we keep making new all-time highs, those highs are only fractionally higher. More than anything the market is coiling over the last eight trading sessions, waiting to make its next move.

Indicators

- Volatility Index (VIX) – The Chinese trade news instantly shot the VIX up to 13.90, but ultimately brought it back down to 13-flat, for only a 2.5% move. Still compressed, and with the tight coiling at these lows, sets the market up for a volatility event.

- T2108 (% of stocks trading above their 40-day moving average): I keep hounding about this, but I find this whole matter quite astounding that the number of stocks that are participating in in the market rally has declined for more than two weeks, the indices have been rising during that same time.

- Moving averages (SPX): Trading above all major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

It was a flight to safety today, as investors pourd their capital into Utilities, Real Estate and Staples. Nothing else really participated. So essentially the market rose higher on investors not wanting to be in growth stocks but in value/safety stocks.

My Market Sentiment

The day was quiet, and while there was some mid-day theatrics, but the market only desired a close at break even. Price is contained within a tight range, and once it breaks out of that box, it will provide the direction for where the market wants to go next.

- 1 Long Position, 1 Short Position.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.