Swing Trading Strategy:

Finally a follow through (kind of)…

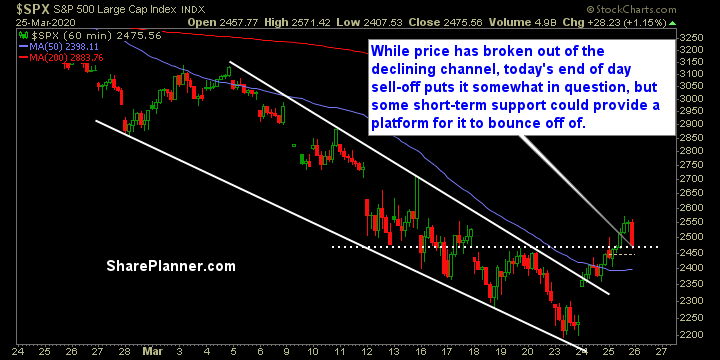

All day long the market looked really solid following its early morning sell-off from the highs of the day. A very strong rebound though and you had what looked to be another triple digit gain for SPX, and then the politicians started talking and down the market went straight down. On top of that Apple (AAPL) said it might delay the 5G launch and it was enough to drive Tech into the red for the day. Tough way to close the day, and in the process I took profits in both positions that I bought at the open today. The first one was Visa (V) where I sold 1/3 for +6.7% and the other 2/3 for +4.3%. Then there was Microsoft (MSFT) that I sold 1/3 for +2% and the other 2/3 for -0.2%. Overall it was a profitable day for me.

I wanted to hold both positions overnight, but weakening into the close and the barrage of bad news, forced me to go back to cash and wait for clearer skies in my trading. Ultimately this market rally of 17% in the last few days from lows to highs on the Dow seems like nothing more than a dead cat bounce to me .We are used to V-shaped market bounces over the last ten years, but this isn’t just a normal market correction and the possibility of another leg down looms large here, especially with the market’s inability to price in so many unknowns in regards to the pandemic that continues to spread and the global shutdown that has resulted.

I am willing to get long again should this market allow me to do so, otherwise I’ll hold on to my cash position and open the door to some shorting opportunities if the market starts to break down yet again.

Indicators

- Volatility Index (VIX) – For the last four days the action on the fear index has been quite different, moving with the direction of the market rather than against it as it usually does. Right now, it remains elevated at almost 64 and looks like it could set up for another move to the 70/80 range.

- T2108 (% of stocks trading above their 40-day moving average): I would expect at this juncture to see prints of at least 8 or 9%, but instead it can’t even close above 3%. A huge concern for the market going forward.

- Moving averages (SPX): Broke above the 10-day moving average for the first time since February 20th. Could see a 5/10 MA cross over to the upside.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

It is hard to have a legitimate market rally when Technology, which houses the biggest companies in the stock market refuses to rally with it. Today it was the only sector to not rally higher. Also of note was the fact that the two leading sectors were Real Estate and Energy – not necessarily sectors investors are begging to get into right now. Only Discretionary and Technology showing any resemblance of a base trying to form.

My Market Sentiment

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.