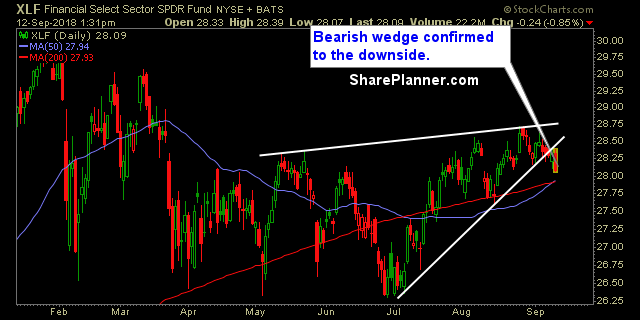

Sectors bullish as a whole, but still with some notable laggards. Financials suck, I’ve played them sporadically throughout the year, and every time, the gains have meager. Energy I have been incredibly skeptical of, though I have played them with much more success, I have stood by on its current rally because the sector itself

Sectors as a whole remain bullish, despite recent market pullback. The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being oversold.

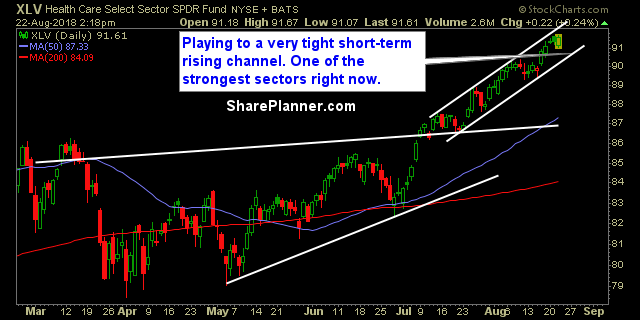

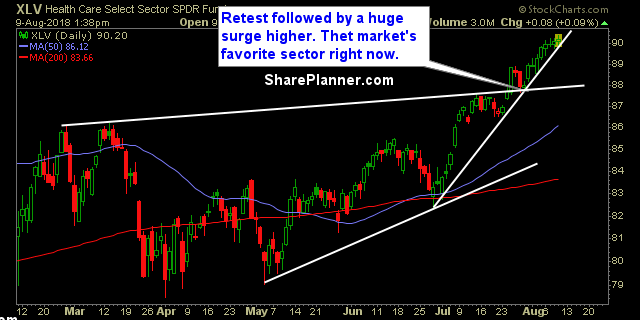

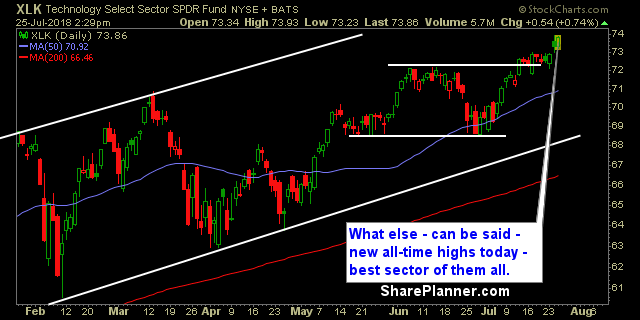

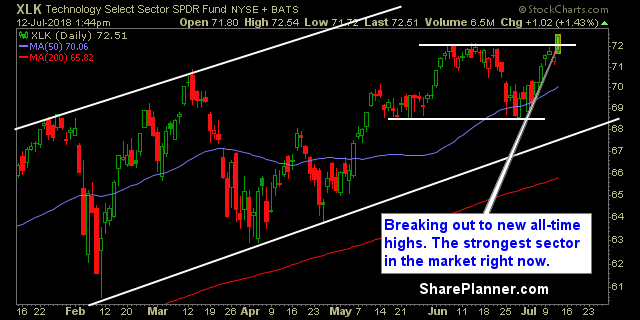

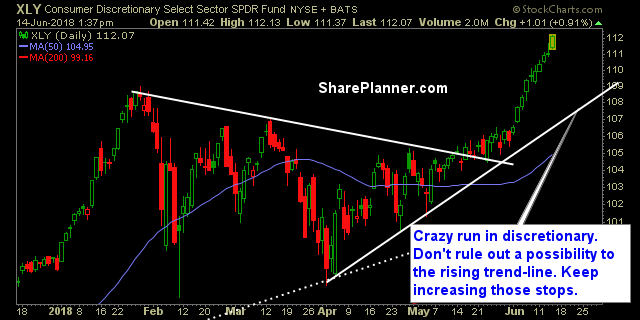

Sectors as a whole support the market’s move to new all-time highs. Outside of Energy and Materials, the sectors as a whole have shown some solid trend-lines and a willingness to push higher going forward.

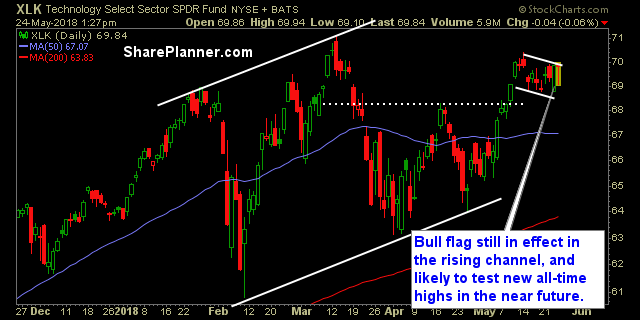

Most of the sectors are showing sideways trading patterns. The market isn't entirely untradeable but it is getting pretty darn close to it. I'm finding the breakout plays to be more difficult than most, and instead focusing on the stocks that are forming a base and coming out of that base, following a sell-off. Most

Reviewing the sector charts - there is plenty to like, from a bullish perspective. Pretty much every sector I looked at, I could find myself a reason for why there could be a bullish take on it. So overall, the charts aren't all that bad. What I am concerned with more than anything else, is

Half the sectors look solid – the other half, not so much. Technology continues to be the place to trade. The thing I have to be careful of is that I don’t get overloaded in that sector, because we have all seen the days where tech is selling but nothing else. So while it is

Recent leading sectors starting to struggle Let’s be honest, it is never good when utilities are leading the way. And not even mentioned in the rankings below, is the fact that staples are starting to show signs of life once again. Meanwhile, technology is struggling, discretionary is showing signs of breaking down and healthcare is

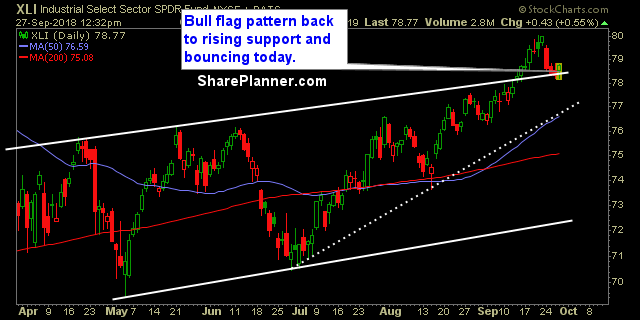

The Leaders of this market still leading In fact if you look at my top three sectors below the only difference is I have swapped out Industrials for Healthcare. Otherwise, the 1-2 punch of this market still remains Technology and Discretionary.

Most of the sectors are in good shape right now. This bodes well for the overall direction that the market has been on this month. Yes, there are some obstacles for it to overcome, in forms of strong price resistance overhead, but we are seeing the typical market resiliency that we saw during much of

There are a lot of positives and a lot of negatives in this market right now. Not all sectors are soaring as you might think. A lot of them are downright miserable. There are also a lot of failed patterns breakouts as you will see below. Those lead the way in terms of worst sectors