So far the Industrial Sector (XLI) can't seem to find the momentum to push through overhead resistance.

Episode Overview Ryan goes over one listener's swing trading journey, analyzes the trading strategy being employed, and answers questions on everything from short squeezes and short floats to insider and institutional buying and sector rotations. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by explaining why he

Episode Overview This episode focuses on Ryan's sector analysis and what he's looking for when determining which sectors to trade from. 🎧 Listen Now: Available on: Apple Podcasts | Spotify | Amazon | YouTube Episode Highlights & Timestamps [0:07] IntroductionRyan kicks off the episode by setting the tone on managing complexity in trading, particularly around sector analysis. [1:13] Listener Question: Otis from

Episode Overview Step-step directions on how I use the Top Down Trading Strategy in my swing trading. This trading strategy guides my decisions and how I analyze stocks and choose which stocks to trade. In this strategy I connect the overall stock market direction with sector strength and industrial technical analysis to help find the

$AMD weekly chart rejected at key resistance levels.

As a new feature to SharePlanner, I'm going to roll out, the SharePlanner Notebook, where I essentially "clear out my notebook" of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

As a new feature to SharePlanner, I’m going to roll out, the SharePlanner Notebook, where I essentially “clear out my notebook” of the charts I went through today, and provide you with some or all of the ones that I found interesting. Some of them, may have been requests from members of the SharePlanner Trading

I don’t have any issues with any of the sectors right now except for Energy. Energy is seriously the most unpredictable and untradeable sector right now. Nothing holds to the upside, and just when you think a stock is breaking out, it reverses course and breaks down on you.

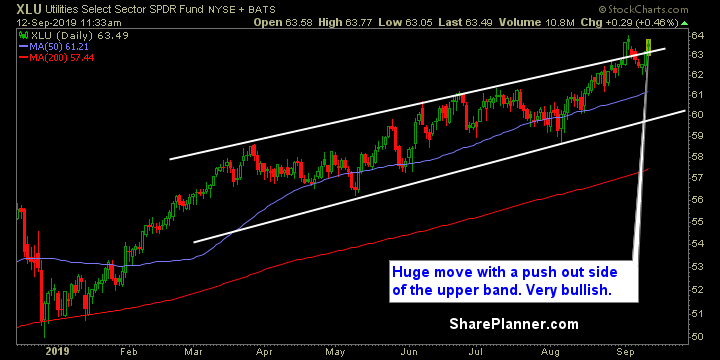

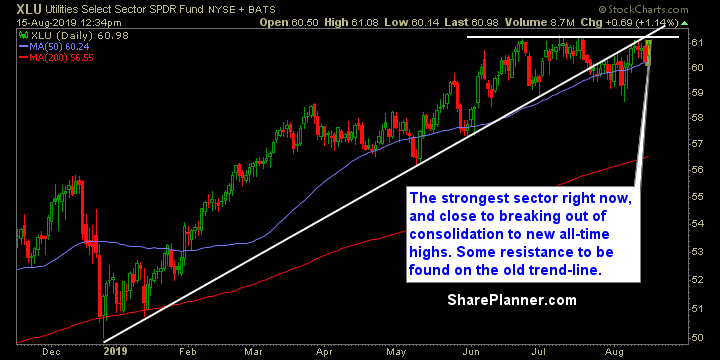

A lot of trend-lines breaks and topping patterns are forming The safe sectors is where big money is putting its capital. Utilities are practically on the brink of new all-time highs. I’d also like to add stocks supporting the military or have big dollars in the Pentagon defense budget are also holding up well and