$MULN simply a time trap as long as it remains stuck in a sideways trading range.

$SIGA continues to struggle at resistance overhead.

$CROX Potential base breakout heading into tomorrow.

Key support to watch on $OXY during this massive oil sell-off.

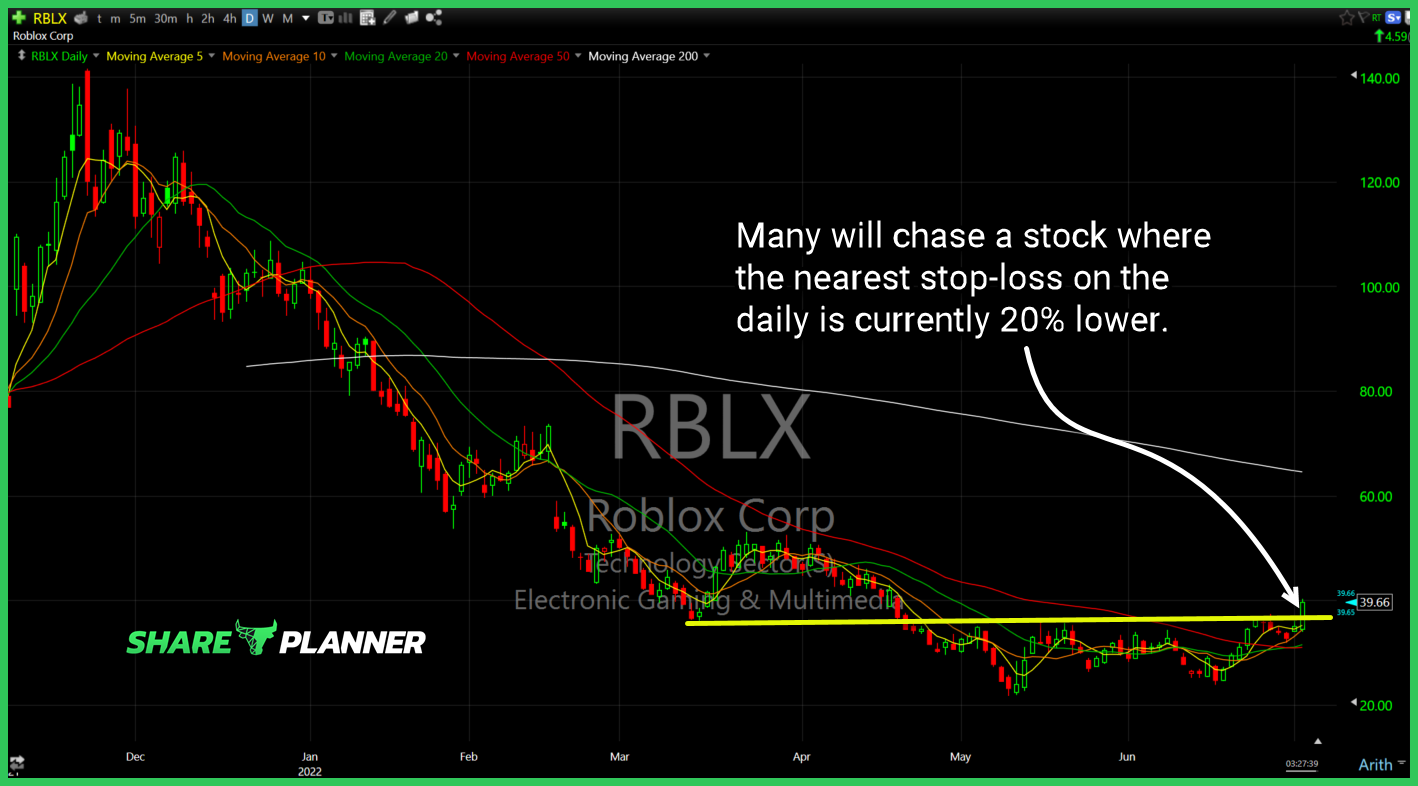

$RBLX Many will chase a stock where the nearest stop-loss on the daily is currently 20% lower.

The stock market crash of 2022 has resulted in the worst first half of trading since 1970. In this video, I provide you with my top 5 swing trading lessons of 2022. Whether you are a beginner at trading or a seasoned veteran, these stock trading lessons can help you to better profit in 2022.

$NVDA breaking major support signals a potential move to $114.

$SI head and shoulders confirmed. Now sitting on a new layer of support – if it breaks should lead to the next leg lower – very volatile though and managing risk will be difficult.

$DWAC selling accelerating & wouldn’t be surprised if this stock hits $10 by year end.

AMD stock has seen its stock price drop by 50% over the last six months. With it trading in the $80's, is now the time to buy AMD stock? Will AMD stock rally back from here or should we expect the stock to crash further? In this video I provide my technical analysis for AMD