My Swing Trading Approach I tried to take NFLX and AMZN overnight but the intraday sell-off forced me to take profits of +1.3% and +0.2% respectively. Today I am looking to add 1-2 positions ahead of the FOMC Statement. Indicators Volatility Index (VIX) - VIX manages to continue its push higher, with another 4.3% rally to

My Swing Trading Approach Nothing much going yesterday. I didn't like the risk/reward to the downside, which in hindsight wasn't actually all that bad considering the extent of the sell-off. I did play the bounce in Amazon early on, and while it looked promising, fell apart in the afternoon. Today I will look to play

My Swing Trading Approach I played SPXU twice on Friday. I closed it out early on when it looked like the bulls might try to take the market back up for a +2.8% profit. But shortly later, I re-entered the trade again, and sold it at the end of the day for another +2.9% profit.

My Swing Trading Approach I didn't add any new positions yesterday, as the market was dull and didn't afford any real trade setups. I still have SPXU and will look great heading into the open today. If the market can wash out the longs and put in a healthy bottom, I'll look at closing SPXU

My Swing Trading Approach I booked my profits in AMZN and NFLX yesterday as the market was starting to pullback. I took +2.5% in NFLX and +1% in AMZN. Right now I am net short on the market, but won't hesitate to get long again, if the conditions merit that. Indicators Volatility Index (VIX) - While

My Swing Trading Approach I added two new long positions yesterday and closed NVDA out at $150.95 yesterday for a flat trade. I will be very tentative about adding any new positions today and will let the market play itself out in order to show it can handle a gap up. Indicators Volatility Index (VIX) -

My Swing Trading Approach I added one new long positions yesterday and look to add another today in the early going. However, tight stops are necessary as it won't take much for this market to reverse course and trend lower yet again. Indicators Volatility Index (VIX) - Matched its highs exactly from last Thursday, but failed

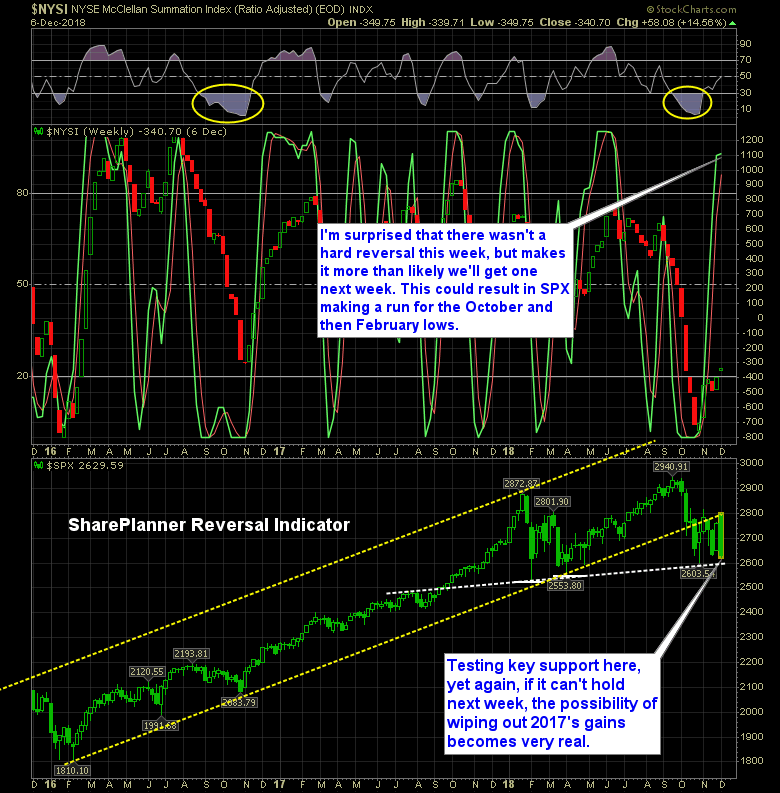

The Bears have held strong ever since Monday’s huge gap up. They have essentially pillaged investors of all their gains from November, and all of 2018, and we are only seven days in.

My Swing Trading Approach I added one long position yesterday that's off to a good start, once the market showed a willingness to bounce and sustain the bounce off of the lows of the day. I will consider adding another long position today should the momentum sustain itself following the jobs report. Indicators Volatility Index