Watch the $ORCL bullish wedge for a potential upside breakout. $NCLH potential bounce area for the stock following a sharp earnings sell-off today. Anybody want to address the elephant in the room? $TLT $AMD nearing a breakout of the bull flag pattern that has been forming since June. Pushing through the $117's into the 118's

$NVDA attempting to the rising trend-line from the January lows and bounce and back to new recent highs.

$FDX attempting to break the 200-day MA and the declining trend-line.

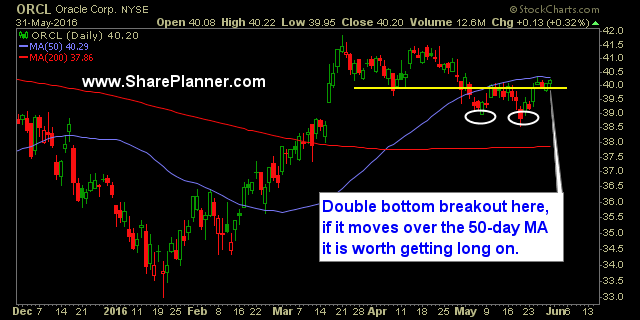

Today's hot stocks watch list Long MGM Resorts International (MGM) Long Oracle (ORCL) Short La Quinta (LQ)

Technical Outlook: A significant technical breakdown played out yesterday on the S&P 500 (SPX) with price breaking down and below major long-term support at 2120. Bear flag was also confirmed by yesterday’s price move. Volume saw a notable uptick yesterday as well on SPDRs S&P 500 Trust (SPY) with volume well above recent averages. In the past, SPX

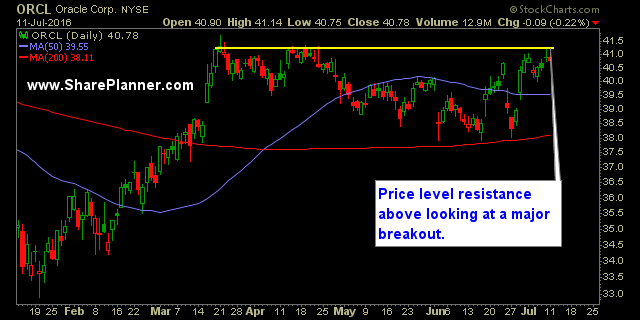

I’ve been watching with great interest to see whether Oracle (ORCL) is going to pull it together and bounce at critical trend-line support or whether it is going to break below it and eventually establish lower-lows under $40. Right now, I say it is still bullish until proven otherwise, but the window of opportunity

It’s July, it’s hot, and so is this market! Get your portfolio right and start consistently profiting in this crazy and volatile market. Join the SharePlanner Splash Zone and start trading with me to see for yourself what a membership can do for your portfolio. Sign up for a Free 7-Day Trial – with your subscription,

It was a great month of trading during the month of May. Get ready for an even better one in June by signing up for the SharePlanner Splash Zone. See for yourself what a membership can do for your portfolio by signing up for a Free 7-Day Trial. With your membership, you will get each and

Technical Outlook: Heavy sell-off yesterday that saw yet another massive afternoon bounce recovering two-thirds of the losses before the close. This was a major failure for the bears. Yet it is what’s been seen by this market time and time again over the last seven years. SPX failed to break 2039 and hold it into

Of course there should be about 15 more dead cat bounce attempts between now and the close, but I have to say, I am pleasantly surprised that the bears have the price action down below 2039. That is where it should be, but my expectations were diminishing rapidly over the past week for that