It’s getting nasty up in hear folks – SPX has broken the 50-day moving average, broken definitively now the rising trend-line off of the November lows, and now we are seeing the VIX creep back up above 20 for the first time since June of this year. So this watch-list is more relevant than

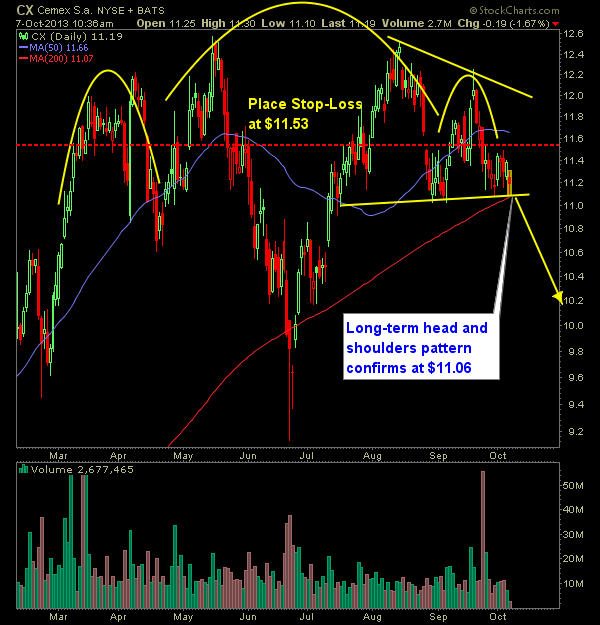

Here are today’s swing trade setups for you to ponder: Short: Cemex (CX):

My Complete Short Watch-List for Swing-Trading The market is showing all sorts of weakness today, and my belief that the dead cat bounce is…well…dead, is at the forefront of my mind right now. With the SPX giving up the day’s gains and heading southward only solidifies my belief. I’ve already added one short

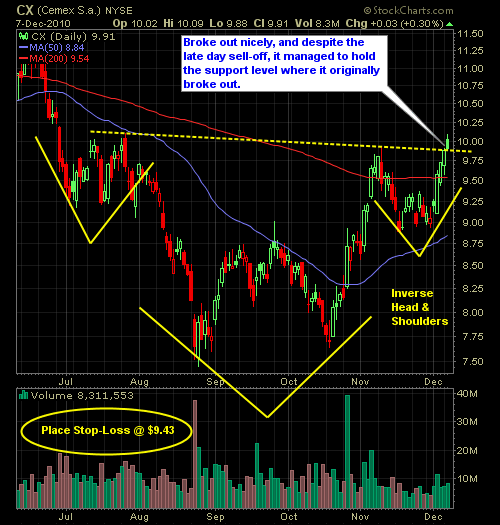

The market definitely puked on the Existing Home Sales report, but the damage isn’t all that bad from a daily perspective – it’s just that it wiped out our early gains quite convincingly. Nonetheless, I am still focused on trading to the long side and will continue to do so, until this market experiences a

Here’s one of your more traditional “Buffett-like” stock screens where I am essentially looking for companies selling well below their book value. With the market getting hammered lately, it would be nice to find those stocks that have minimal downside risk, based purely on company valuation. The stocks below represent those companies that are trading