Become a profitable swing-trader by jumping into the SharePlanner Splash Zone with a with a Free 7-Day Trial. With your membership, you will get each and every trade that I make with real-time text and email alerts (international too) as well as access to my world-class chat-room that I trade in each and every day. Click Here to Join!

With July well underway in the SharePlanner Splash Zone, it is shaping up to be another great month. You can experience the same kind of successful trading by jumping into the Splash Zone out with a with a Free 7-Day Trial. With your membership, you will get each and every trade that I make with real-time text and email

Join my trading room by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). If you’d like to see just how good my past performance has been, you can do so by clicking here. Here’s

Join me by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). If you’d like to see just how good my past performance has been, you can do so by clicking here. Here’s tomorrow’s swing-trading

Members of the SharePlanner Splash Zone are having an outstanding month (and year) – and I encourage you to become part of our success by signing up for a Free 7-Day Trial to the Splash Zone where you’ll receive access to my Trading Room and Real-Time Trade Alerts via text and email (including international numbers). You can also

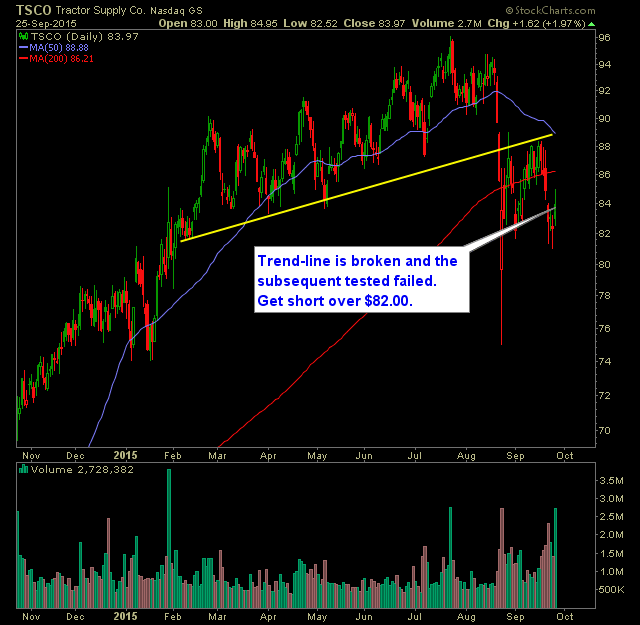

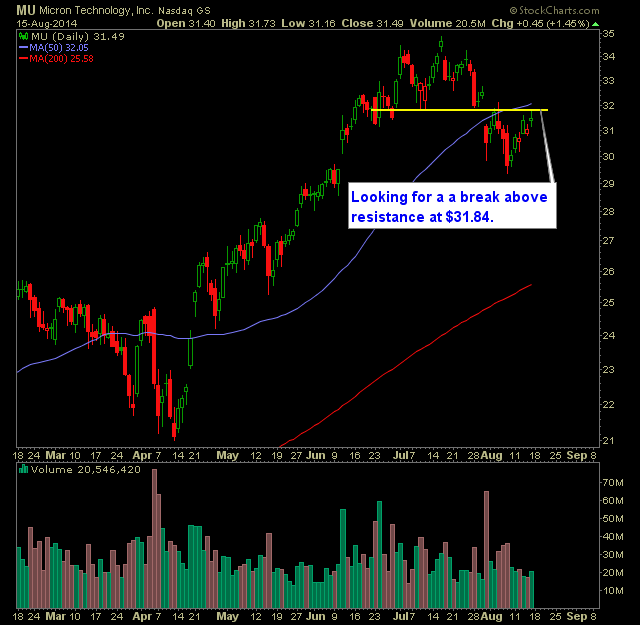

Be sure to sign up for the SharePlanner Splash Zone Free 7-Day Trial and receive access to my chatroom and real-time trade alerts via text and email (including international). You can also automate all my trades through Ditto Trade. Click here to subscribe. Here is tomorrow’s swing-trading watch-list: Long Micron Technology (MU)

I didn’t do a Lazy Trade posting on Friday (but that doesn’t mean there wasn’t a ton of trading ideas posted) so I didn’t want another day to go by without doing another one. The S&P 500 has done a great job of recovering off of the morning lows and holding those new intraday highs.

I am not overly surprised at today’s market action. At one point I was down about 1/2 percent, but managed to recover and finish slightly in the positive on the day, and when I say slightly, I’m talking by a razor-thin margin. One disturbing situation though was the heavy selling in the Nasdaq, which

The market, for the first time this month has seen a fair amount of selling as it fell back below the 1130 breakout level on the S&P. The question on the minds of the bulls is whether this is something to be concerned about or to use as an opportunity for buying stocks on the

Happy Monday to you all! Futures are coming out of the gates on a mission, with the Dow, so far up, 54 points, the NASDAQ up 8 points and the S&P up 7 points. Overnight, the Asian markets were up about 1.3% on average while the European markets are currently trading with gains in excess of 1%.