Here’s tonight swing trade setups for tomorrow’s market: Long Acadia Pharmaceuticals (ACAD)

Today’s day-trading in the SharePlanner Trading Block was simply awesome. With the Primary gains coming from CSIQ, DDD, LULU, and FSLR, Oscar managed to add a nice $361 to our minimum sized portfolio of $25,000 and increasing our gains for the month to 8.6%. Not bad. Not bad at all! Here’s all of Oscar’s

Here’s tonight’s trade setups for tomorrow’s market. Remember I’ll be publishing my entire bullish watch-list tomorrow, followed by the complete bearish watch-list Tuesday. So check back for that. It’s hard to lean anyway but bullish until we can see some support levels violated and right now that isn’t in the cards. When it will be

Big move for Citigroup (C) today as it breaks out of the triangle pattern to the upside. Above $51.50 should attract additional buyers as well. There continues to be a huge level of support for the stock at the 200-day moving average, so that any move below it, should be a strong reason to exit any longs

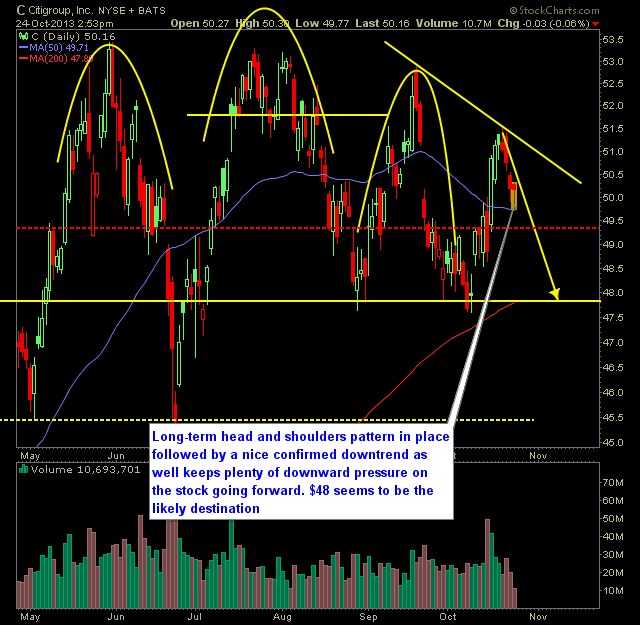

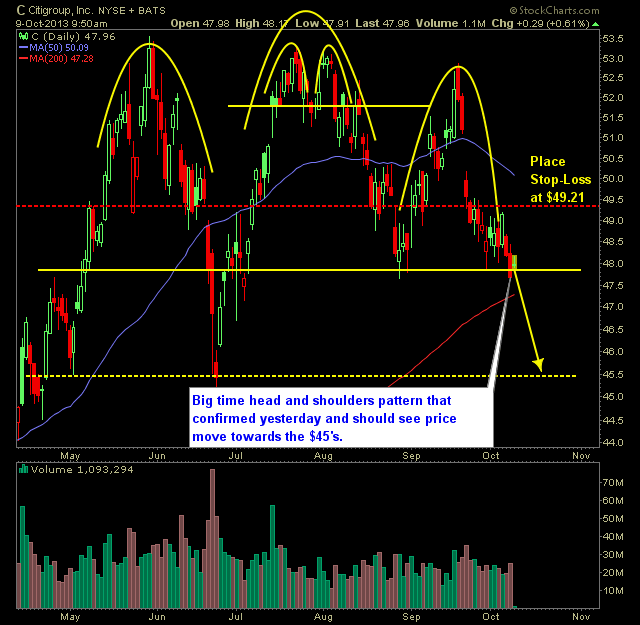

Long-term head and shoulders pattern in place followed by a nice confirmed downtrend as well keeps plenty of downward pressure on the stock going forward. $48 seems to be the likely destination Here’s the technical analysis:

A nice combination of longs and shorts to consider today in your trading: Short: Citigroup (C)

Futures, after a rough overnight session, are slowly but surely making their way back into positive territory. Once again, what was a promising start for the bears, has been nearly wiped away again. Citigroup (C) reported solid earnings, and there are a few mergers and acquisitions out there this morning. But ultimately, all eyes

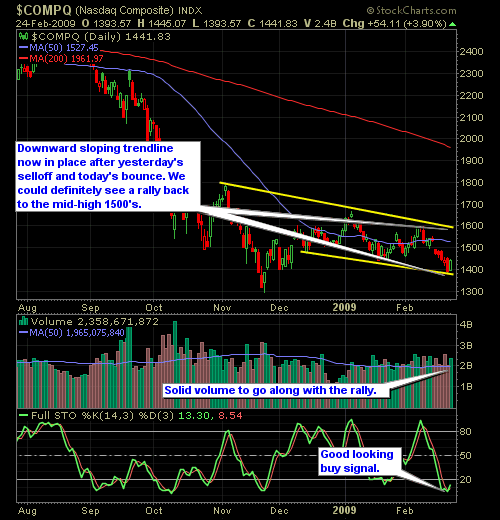

Bernanke’s words before Congress made him seem like the most level headed person in Washington. He warded off the notion that the feds would step in and nationalize the Citigroup (C) or Bank of America (BAC). He also gave some optimism at the prospect of a turnaround in the economy by year end.

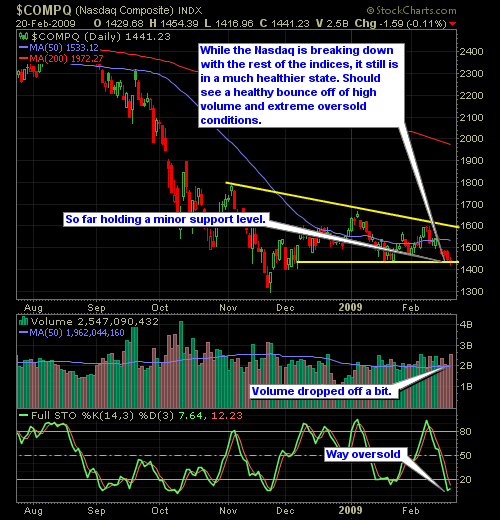

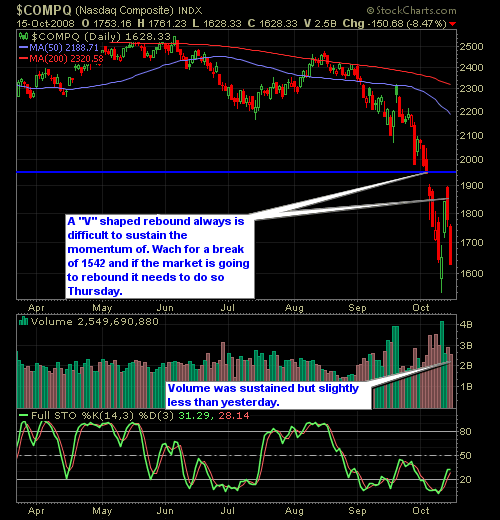

Another round of fear has hit the markets, with worries now that the Dow is hitting fresh lows (we could honestly careless about this index as it is price weighted). The indices of great importance though is the S&P 500 and NASDAQ. The NASDAQ is hanging strong – as it has not seen near the

Monday’s gains are a distant memory and the market is now looking at breaking Friday’s lows. If so, you could see further panic on Wall Street with the liklihood becoming more certain that Wall Street will test the lows from the Tech-Bust in late-2002. Citigroup reports tomorrow morning, and could cause even more volatility to