I just finished off another stellar month of trading in November. See all that I have to offer you by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone where you will be given access to the member chat room as well as receive all of my swing-trade alerts via email and text (international

Join me by signing up for a Free 7-Day Trial where you will be given access to the member chat room as well as receive all my swing-trade alerts via email and text (international too). If you’d like to see just how good my past performance has been, you can do so by clicking here. Here’s tomorrow’s swing-trading

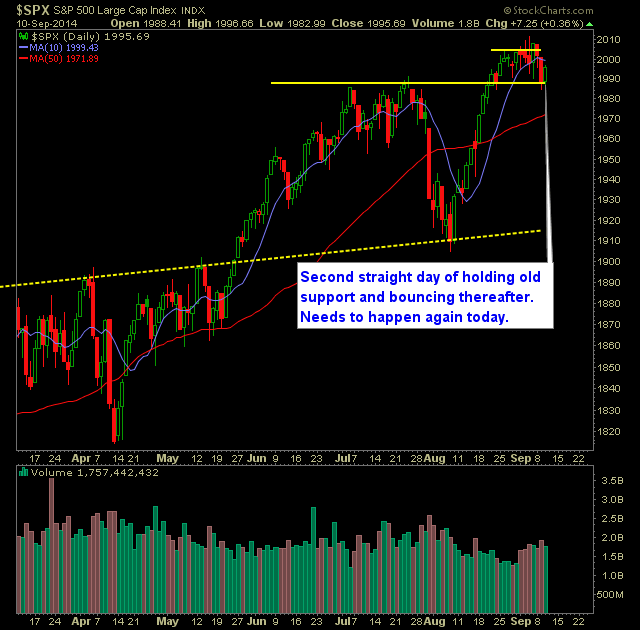

Pre-market update: Asian markets traded -0.5% lower. European markets are trading -0.5% lower. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), PPI-FD (8:30), Redbook (8:55), Treasury International Capital (9am) Technical Outlook (SPX): Yesterday’s price action saw the dip buyers come

Pre-market update: Asian markets traded -0.2% higher. European markets are trading flat. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): Empire State Manufacturing (8:30), Industrial Production (9:15) Technical Outlook (SPX): Friday nullified the notion that the action from the previous two days was an

Pre-market update: Asian markets traded 0.1% higher. European markets are trading flat. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): Retail Sales (8:30), Import and Export Prices (8:30), Consumer Sentiment (9:55), Business Inventories (10) Technical Outlook (SPX): For a third straight day, SPX tested

Pre-market update: Asian markets traded 0.3% higher. European markets are trading 0.7% lower. US futures are trading 0.4% lower ahead of the market open. Economic reports due out (all times are eastern): Jobless Claims (8:30), Quarterly Services Survey (10), EIA Natural Gas Report (10:30), Treasury Budget (2) Technical Outlook (SPX): SPX tested support at 1887 yet

Pre-market update: Asian markets traded 0.4% lower. European markets are trading 0.1% lower. US futures are trading 0.1% lower ahead of the market open. Economic reports due out (all times are eastern): MBA Purchases (7), Wholesale Trade (10), EIA Petroleum Status Report (10:30) Technical Outlook (SPX): SPX broke support at 1990 which represented the lows of

Pre-market update: Asian markets traded 0.1% higher. European markets are trading 0.2% lower. US futures are trading flat ahead of the market open. Economic reports due out (all times are eastern): ICSC Goldman Store Sales (7:45), Redbook (8:55) Technical Outlook (SPX): Disappointing day for SPX yesterday as it failed to hold the breakout level that it

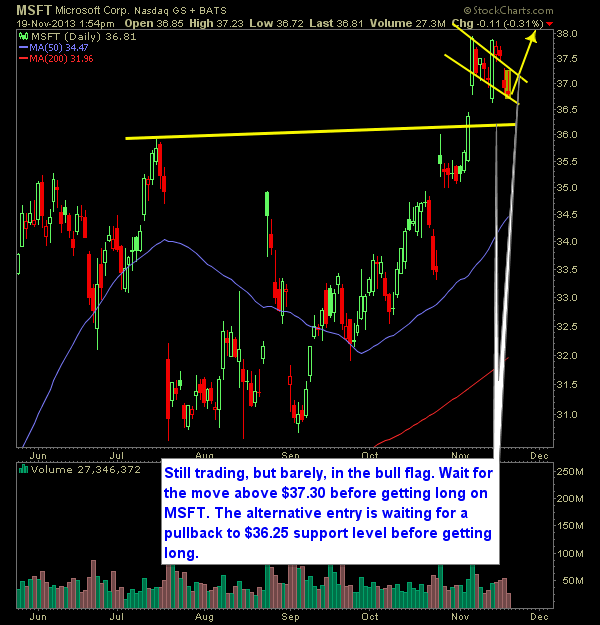

Microsoft (MSFT) is still trading, but barely, in the bull flag that I’ve been outlining for a couple of weeks now. Wait for the move above $37.30 before getting long on MSFT. The alternative entry strategy is to wait for a pullback to the $36.25 support level before getting long. Overall, I consider MSFT