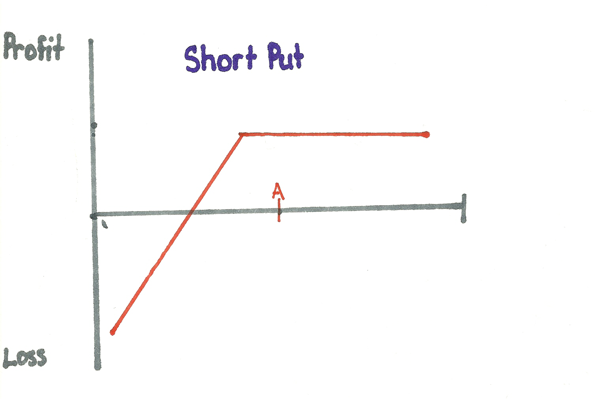

Name: Short Put

Setup: Sell (short) a put

Bias: Neutral to Bullish

Break-Even: Strike – Premium received for the sale of the put

Max Profit: Limited: To premium received

Max Loss: Limited: If the underlying falls below your strike price losses will occur – but are limited due to the fact the underlying cannot fall below $0.00

Margin: Short call requires no cash outlay so margin is used. Margin is calculated by taking the greater of:

- 25% of the underlying security value minus the out-of-the-money amount plus the premium received or

- 10% of the underlying security value plus the premium received

Time Decay: As time passes the put will drop in value which is what you want. You want your short put to lose value so it expires worthless or allows you to buy it back (close it) for a lower price.

Implied Volatility: Over the life of the option you want implied volatility to decrease, thus decreasing the price of your option. An increase in implied volatility will increase the price of your option.

Notes: Short puts can profit no matter which direction the underlying moves. Losses will only occur below break-even. Selling deep out-of-the-money puts can return high probability plays. Short puts can also be turned into cash-secured puts. This is setup by holding enough cash to buy the shares if the underlying falls below the strike price. This is a good way to pick up shares at a reduced price. For example if the underlying is currently trading at $65 and you are willing to purchase the stock at $60 then you could sell the put on the 60 strike. If the underlying falls below 60 you will be assigned the shares and now have a long stock position. This is more typical for picking up long-term holdings.

Featured in Trade Reviews: None at this time

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.