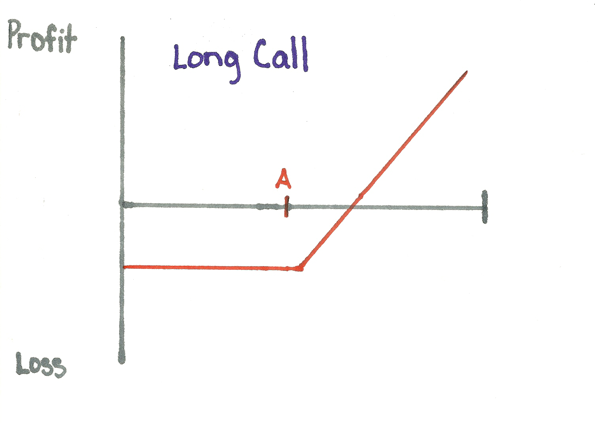

Name: Long Call Description: The long call gives the buyer the right to purchase the stock at the strike price. You want to buy a call if you believe the price of the underlying is going to go up. Calls offer insurance over buying the stock outright since you can only lose the price of

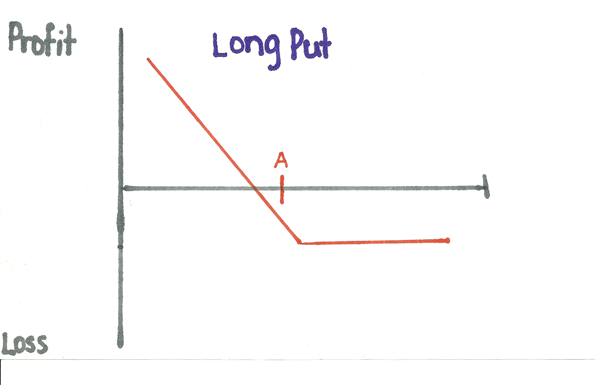

Name: Long Put Setup: Buy (long) a put Bias: Bearish

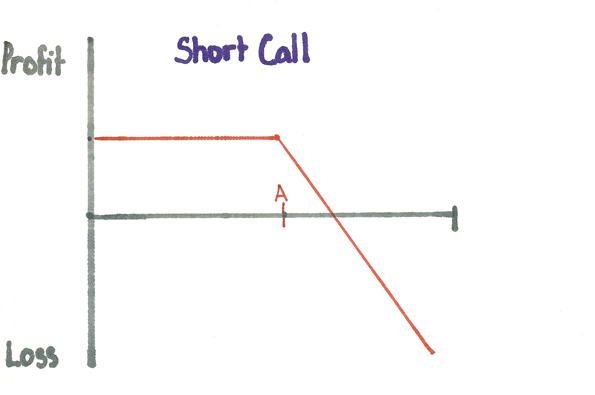

Name: Short Call Setup: Sell (short) a call Bias: Neutral to Bearish

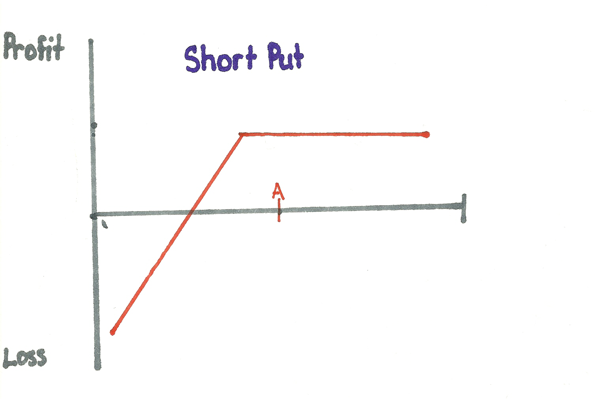

Name: Short Put Setup: Sell (short) a put Bias: Neutral to Bullish

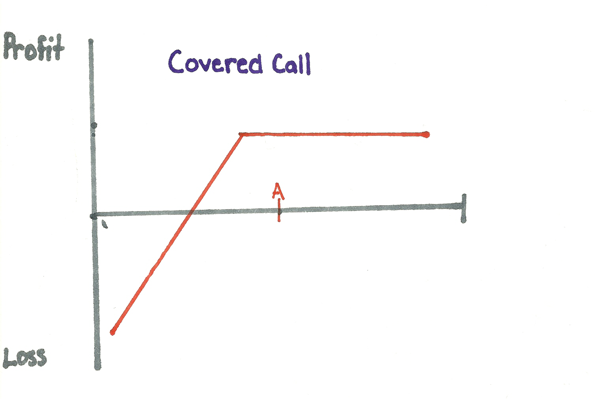

Name: Covered Call Setup: Sell (short) a call and Own or Buy (long) equal amount of shares Bias: Neutral to Slightly Bullish (If the underlying sky rockets in price you will be forced to sell at the strike price missing out on the extra gains)

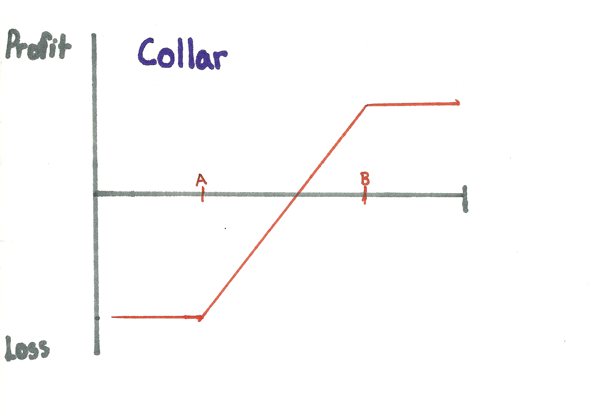

Name: Collar Setup: Own the stock and Sell (short) a call and Buy (long) a put Bias: Neutral to Slightly Bullish (If the underlying sky rockets in price you will be forced to sell at the strike price missing out on the extra gains)

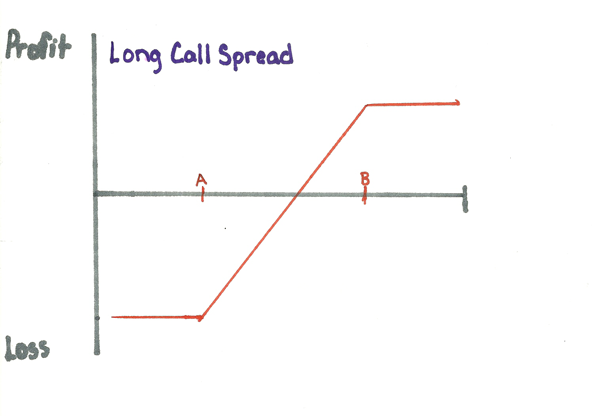

Name: Bull Call Spread or Vertical Spread Setup: Buy (long) Strike A call and Sell (short) Strike B call – same expiration month for both Bias: Bullish with a target at the short strike

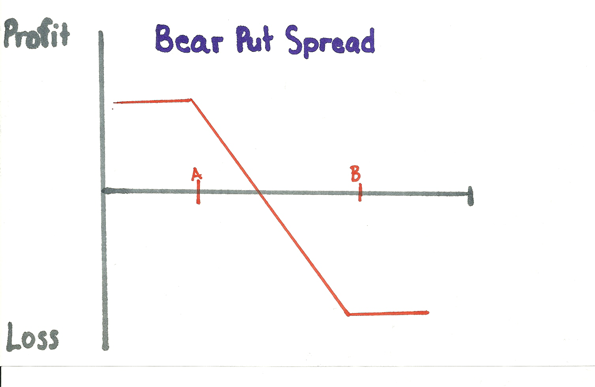

Name: Bear Put Spread or Vertical Spread Setup: Buy (long) Strike A put and Sell (short) Strike B put – same expiration month for both Bias: Bearish with a target at the short strike

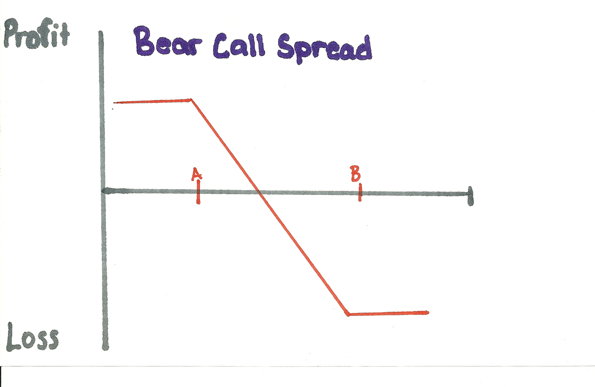

Name: Bear Call Spread or Vertical Spread Setup: Sell (short) Strike A call and Buy (long) Strike B call – same expiration month for both Bias: Neutral to bearish

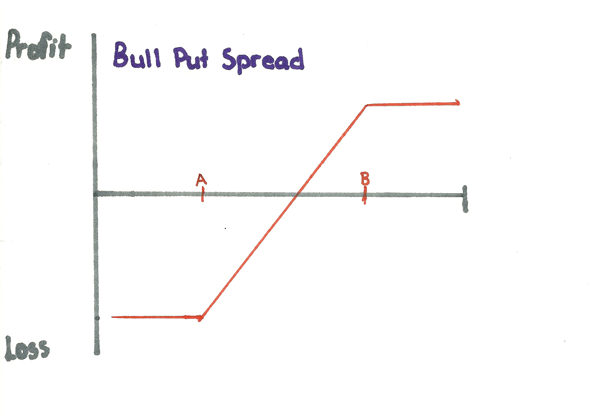

Name: Bull Put Spread or Vertical Spread Setup: Buy (long) Strike A put and Sell (short) Strike B put Bias: Neutral to Bullish