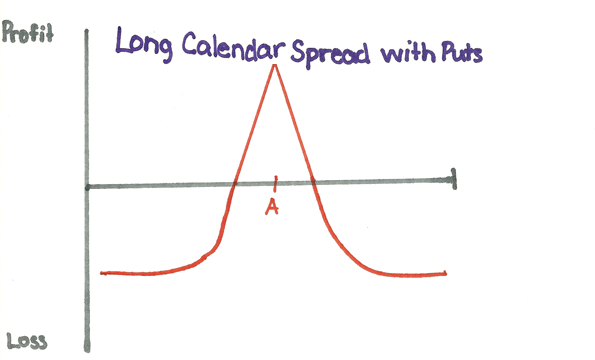

Name: Long Calendar Spread w/ Puts

Setup: Sell (short) Strike A put (front month) and Buy (long) Strike A put at a later month (back month)

Bias: Neutral

Break-Even: Due to the fact that it is played over two different expiration months determining an exact breakeven point is difficult

Max Profit: Limited – Credit received from short put minus the time decay lost on the long put

Max Loss: Limited – Debit paid

Margin: Since the trade is paid for no margin is required

Time Decay: Time decay is your friend in this play since it will speed up the decline of the short front month option faster than the back month option

Implied Volatility: Implied volatility’s effect is mixed in this case. On one hand you want volatility to increase because it will drive up the price on the long back month option. However, you do not want the stock to move a lot as this is a neutral play.

Notes: None at this time

Featured in Trade Review: None at this time

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.