Where did that rally come from?

I woke up this morning, and thought maybe I was looking at the Nasdaq futures and not the S&P 500 futures. I saw a 93 point rally underway and thought “That ain’t right!”.

Low and behold it was. Asian and European markets liked what they saw and they took off, and with it, the the US futures.

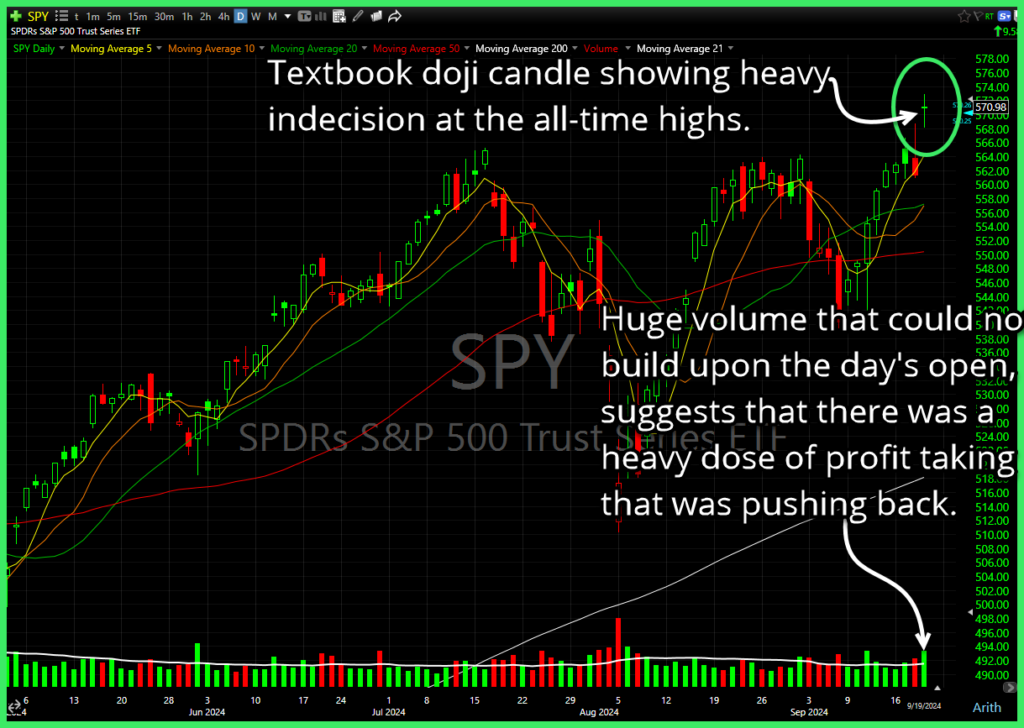

Previous two trading sessions the bulls had struggled with holding the breakout to new all time highs, and as I’ve mentioned before, when the market struggles to break through key resistance levels on the indices during regular trading hours, it will instead run the futures higher, often to absurd levels, so that price gaps well above the resistance and no longer has to deal with that challenge.

You don’t really see such deliberate behavior with individual equites, but in the index futures – ABSOLUTELY!

At the end of the day, you had a sell-off that created a near perfect doji candle, signifying indecision at those price levels by both the bulls and bears. In fact, the closing price was slightly lower than the open price.

Should we be surprised that this market is putting in all-time highs, when every thing around feels like it is falling apart?

Not at all!

It’s expected. Parties in power are going to leverage that power for their own political gain – unless you know, there’s a housing and banking collapse (2008) or some lab created disease released on all of humanity (2020). Otherwise, yeah, expect all-time highs in the height of election season. During 2000’s Dot Com bubble we had already started pulling back off the highs, but most weren’t aware of the ultimate sell-off that was still yet to come – and that didn’t happen until after the election.

How did I fare?

For me, I booked profits of 3.3% in DR Horton (DHI) – as I didn’t want to put to chance my gains with Lennar (LEN) reporting after the bell, and for the past year they have done nothing but disappoint and drag DHI down with it. Once again they managed to disappoint and do exactly that. Fortunately, I don’t have to deal with that tomorrow. I also added some exposure in semis, but on the whole, my overall exposure in the market remained unchanged from the day before. I also managed to book some of my gains in TransUnion (TRU) for a +7.4% profit.

So overall, yeah, it was pretty decent day .

Become part of the Trading Block and get my trades, and learn how I manage them for consistent profits. With your subscription you will get my real-time trade setups via Discord and email, as well as become part of an incredibly helpful and knowledgeable community of traders to grow and learn with. If you’re not sure it is for you, don’t worry, because you get a Free 7-Day Trial. So Sign Up Today!

Hope to see you in there!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.