6/1: Bouncing today off of the rising trend-line from the April lows and looking to continue pushing higher with little resistance until price gets into the $30's.

Where do you begin to make sense of this week, much less of this overall market. It is why I am a fervent believer in being aggressive with the gains that we have in hand and in terms of closing them out. That won't always be the case. I, more than anyone enjoy letting a

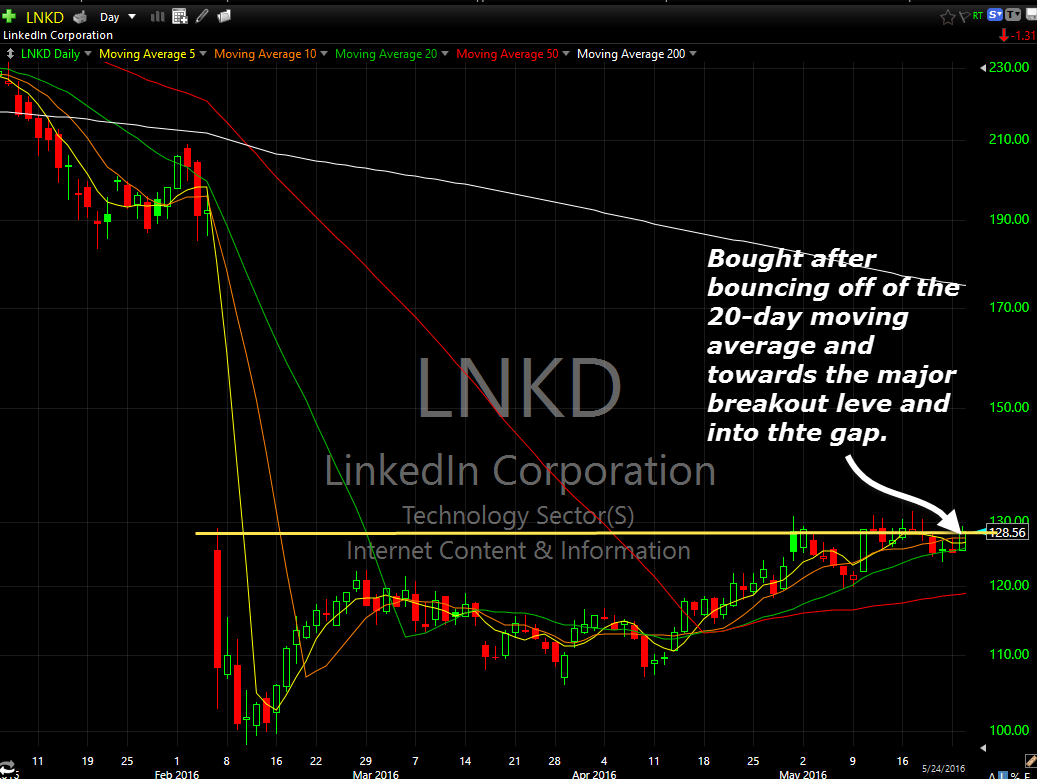

5/24: LNKD following their horrific sell-off after their February earnings report, has created a very nice base that it is now attempting to break out of and push into the gap. We day-traded th is stock earlier in the month and made a solid gain. I think here it is still a strong setup and

5/25: Nice bull flag tthat over the last two days it has fought to break through and establish new highs in. Broke today above the 5-day and 10-day moving average, with a nice series of higher highs and higher lows in place. I expect recent highs to be taken out very soon. It goes without

5/26: Short-term cup and handle. There is some resistance overhead with teh 200-day moving average, but also has some decent support underneath with the 5-day moving average.It is hard to get a good risk/rreward entry on $TSLA so, it can require being aggressive on the entry.

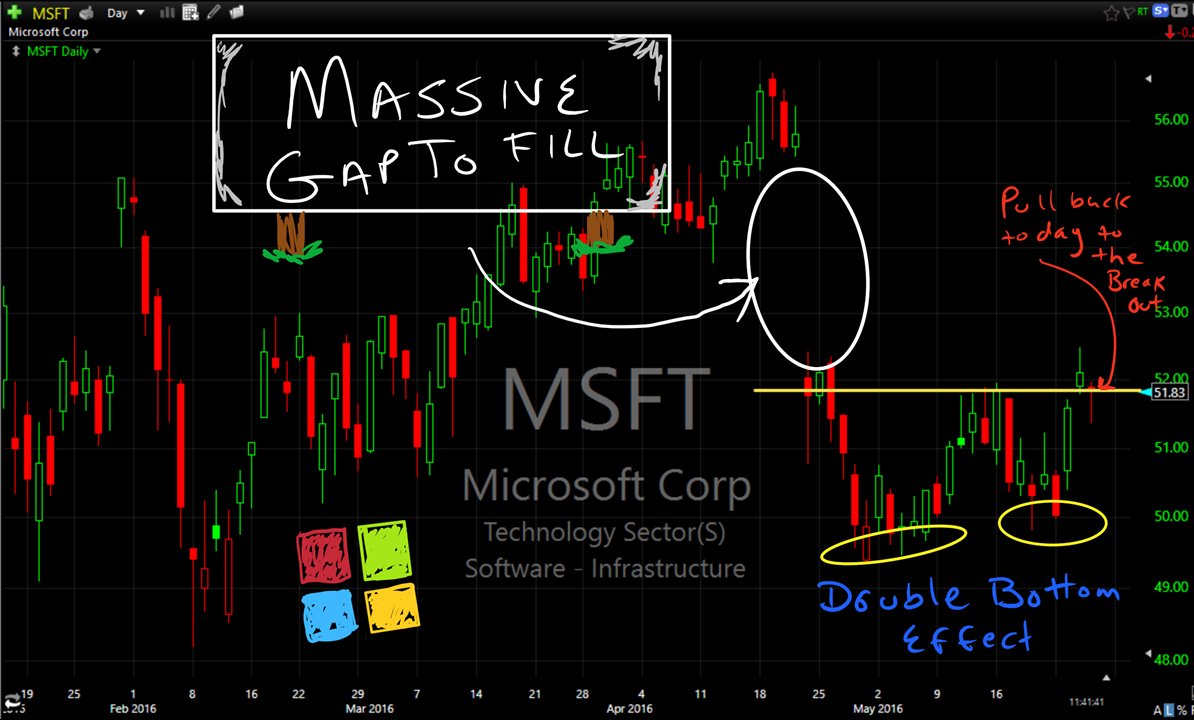

5/26: Double bottom price action that was confirmed at its neckline yesterday. Using today's weakness to buy the dip and see whether we can ride this trade into the massive gap for a fill.

It is a common theme for the market: S&P 500 gets to a key breaking point, everything is lined up for a big sell-off, but bulls and dip buyers come to the rescue and thwart the big breakdown. I mentioned in the last update, that I wouldn't be surprised to see us sell-off early on

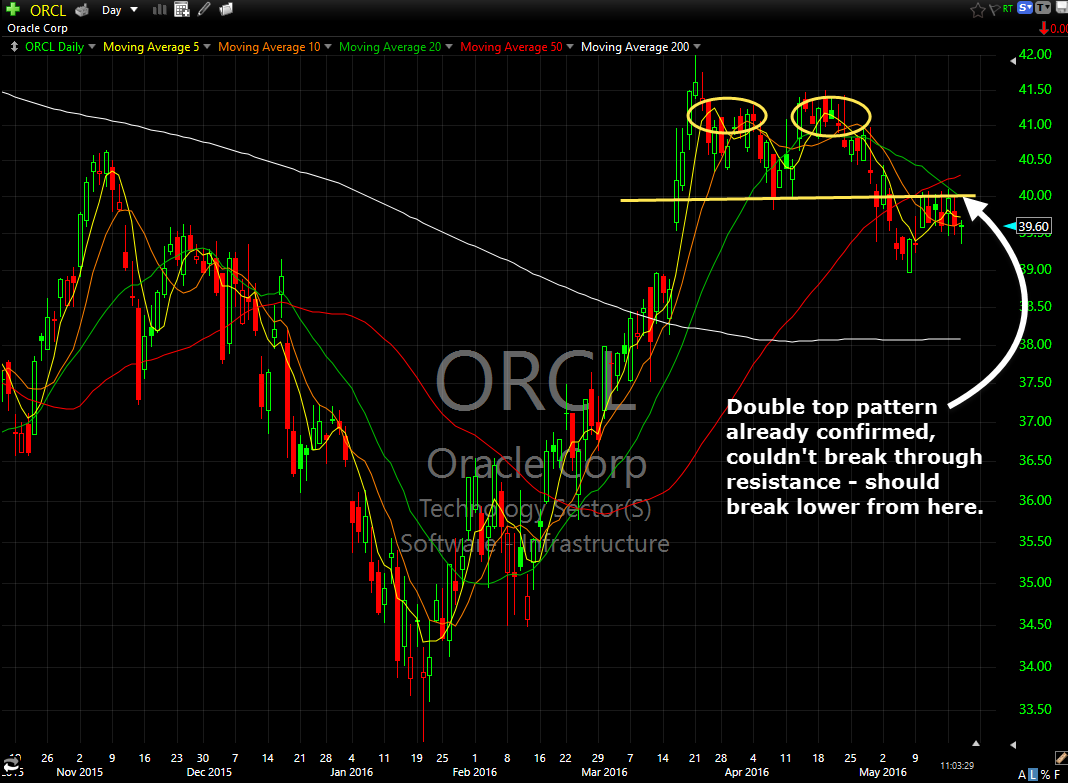

A beautiful double top much like what we talked about on 5/3 when we shorted it then. I am looking for a strong leg down here. Essentially, you a bear flag that can't push through the 50-day or 20-day moving averages. Confirmation on SPX head and shoulders pattern should speed up the downside of this

Fairly significant pattern still working itself out. Appears to me that the price action of late is a dad cat bounce that should be shorted. Looking for the initial move to take price down to $700, then $675. Also the rising trend-line off of the August lows has been violated and broken. Last week it

Second go around on MA short this month. First time didn't yield us the results we were seeking. However, the chart is still ideal for a drop lower. I'm looking for a move down to $89-$91 area. All the MA's are overhead, and looks ready to roll over. Using today's strength in the market to