7/5: Nice distribution overhead, with price being rejected at the $64 level and looking to test the brexit lows again. Tight risk, offering a promising reward.

To put last week into words and the Friday that proceeded it, will be difficult to do. It is a rarity that price action behaves in the manner that it did. In fact, for the market to be down 4% on the month with only 3 trading sessions remaining, and yet wind up in the

6/29: Looking for the bounce back above key support to hold and drive price back towards the key moving averages in the $128-130 range. If they hold, I expect for a push towards the top of its current trading range at $134-136

6/29: Initially, a negative response to its earnings report, has since opened strong and now looking to climb higher on the 5 minute chart as well as the 30 minute chart. Some resistance at $55 to pay close attention to. Solid risk/reward on this trade.

If you are finding this market insanely crazy, you are right it is. I can throw stat after stat out there that proves just how crazy June has been for traders. I mean, how often do you find the S&P 500 within 1% of establishing new all-time highs, to suddenly trading in negative territory for

6/17:Cup and handle pattern in play on LVS. Held up well to recent 5 day sell-off by stocks and is now ready to break out of the pattern and base that it has been in for the past 2.5 months. Also, its competitors are showing a lot of strength of late - namely MGM and

Last week was one of the tougher trading weeks we've seen this year. It was the classic, "stairs up, elevator down" move for the market. Essentially the last two trading sessions wiped out nine days of upward price movement. 1. That is why I have been seeking to book profits along the way when we

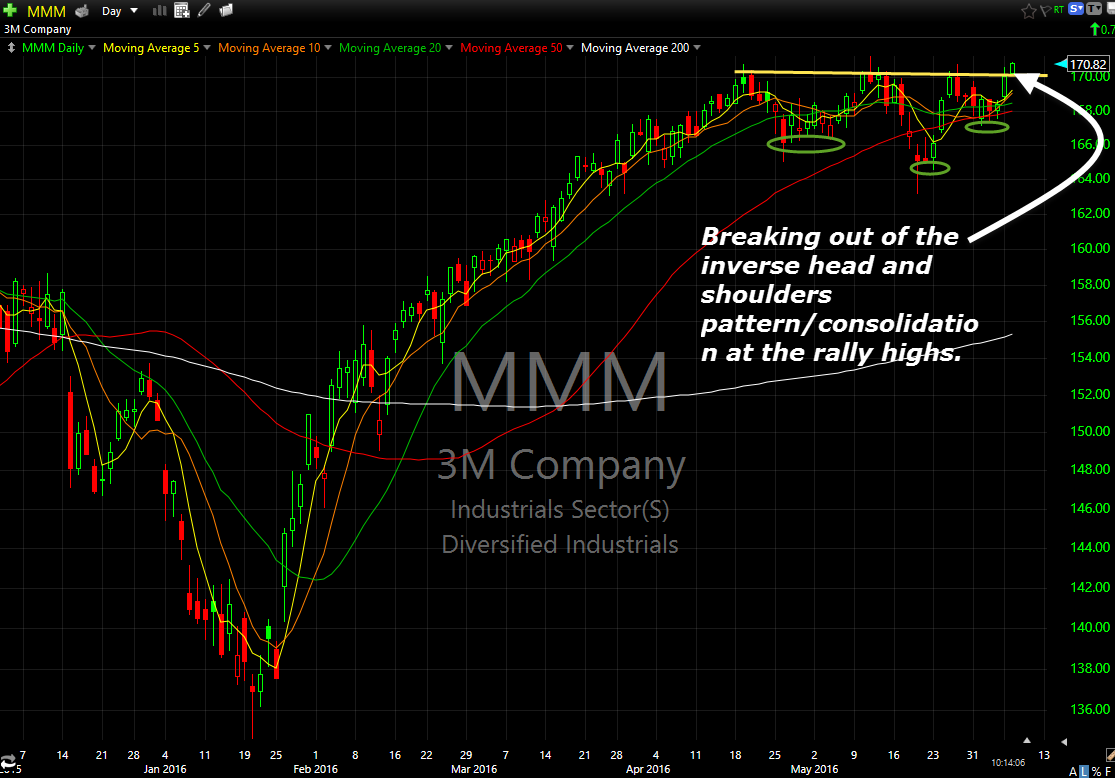

6/7: Breaking out of the recent price range from the past two months with an inverse head and shoulders pattern at the highs. Support at the 50-day moving average.

It is hard to characterize this market as anything other than choppy and that is exactly what it has been so far in the month of June and the past 8 trading sessions. There is reason to believe that the market should be problematic this summer with FOMC rate increases on the table and the

6/2: Nearly three months of consolidated trading that it is starting to emerge out of. Once this happens, this is a risk reward setup that could return 3:1 for the amount risked. Continues to find support at the 50-day MA and looking to make an intial push towards $37 for starters. Once that is cleared,