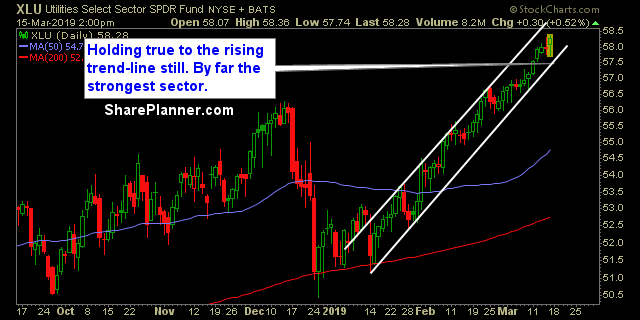

Resistance being tested in nearly every sector. Unless you are utilities, you have some resistance sitting just above your current price. Though overall, the market needs to break through it all at every level if it has any desire to keep this market rally going. The good thing is, that once it breaks, it should

A stock market correction today happens faster than ever. The stock market today can crash incredibly fast, and then put in a bounce in the form a v-shape that is much quicker than anything we have ever seen before. In this podcast, I address how stock market corrections have evolved over the years with electronic

A stock market correction today happens faster than ever. The stock market today can crash incredibly fast, and then put in a bounce in the form a v-shape that is much quicker than anything we have ever seen before. In this video, I address how stock market corrections have evolved over the years with electronic

A stop-loss should be used on every single swing-trade and day-trade that you make. No excuses. Stop-losses are absolutely the best and most simple way for preventing massive losses - well, that and not playing earnings or some major FDA announcement on penny stock biotech company. The point is, if you are going to trade

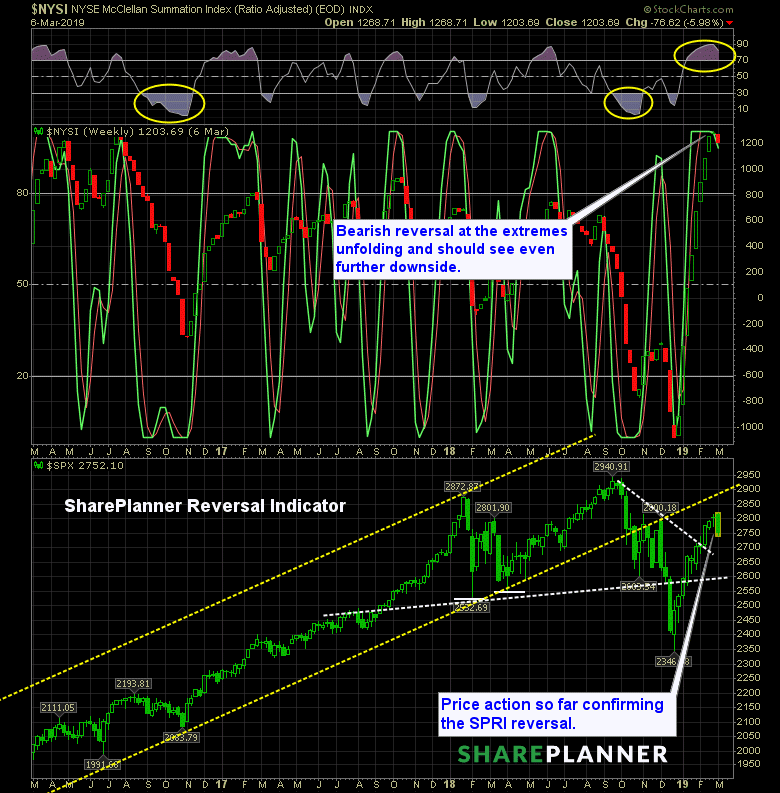

Bearish on my reversal indicator For nine out of the last ten weeks, the market has risen in a ferocious manner. Unhinged you may even say. But this week has been quite different, and on the weekly chart the bulls are staring into the face of a bearish engulfing candle pattern. More importantly is the indicator

A stop-loss should be used on every single swing-trade and day-trade that you make. No excuses. Stop-losses are absolutely the best and most simple way for preventing massive losses - well, that and not playing earnings or some major FDA announcement on penny stock biotech company. The point is, if you are going to trade

The bullish engulfing candlestick pattern is composed of two candle lines. The first one is a red one, and the second one is a green one that is bigger than the prior candle, thereby engulfing the entire body of the previous candle. The bearish engulfing candlestick pattern is composed of two candle lines. The first

Industrial sector continues to be one of the best sectors to trade in. That is namely because Boeing (BA) is soaring through the stratosphere and they are and remain the best stock in the industrial sector. The best time to be buying into it is on any test of the 10-day moving average as it has

Position sizing is so incredibly important when it comes to successful trading in the stock market. But at times, you can have too many positions at once and it leads to horrible consequences to your portfolio. Having the right approach is so key to insuring consistent and sustainable profit generation from the stock market. Position

A winning trading strategy is largely believed to be the result of buying low and selling high, and of course that is a large part of it, but what allows us to where we are doing that consistently? In my latest episode of my financial podcast, I will dive into how our personality traits are