Current Long Positions (stop-losses in parentheses): PEP (70.10), STZ (22.20), FTR (8.57), CB (64.32), PCLN (502.75), KCI (57.69) Current Short Positions (stop-losses in parentheses): None BIAS: 50% Long Economic Reports Due Out (Times are EST): None My Observations and What to Expect: Futures are slightly lower heading into the open. Asia was flat during

Current Long Positions (stop-losses in parentheses): NTAP (52.45), PEP (69.75), RSH (15.93), STZ (22.20), CHKP (54.19), SSO (53.35) Current Short Positions (stop-losses in parentheses): None BIAS: 60% Long Economic Reports Due Out (Times are EST): ICSC-Goldman Store Sales (7:45am), Housing Starts (8:30am), Redbook (8:55am), Industrial Production (9:15am) My Observations and What to Expect: Futures

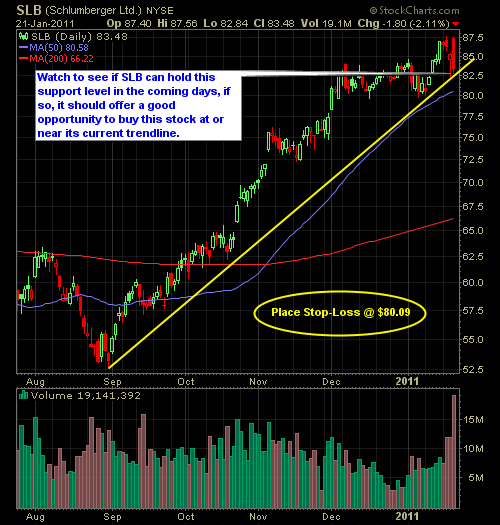

Here are Monday’s Daily Long and Short Setups… LONG: Schlumberger (SLB)

Current Long Positions (stop-losses in parentheses): TICC (8.64) Current Short Positions (stop-losses in parentheses): SPY (113.30), DELL (13.26), FL (13.81), URBN (36.60) BIAS: 44% Short Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), Empire State Manufacturing Survey (8:30am), Import and Export Prices (8:30am), Industrial Production (9:15am), EIA Petroleum Status Report

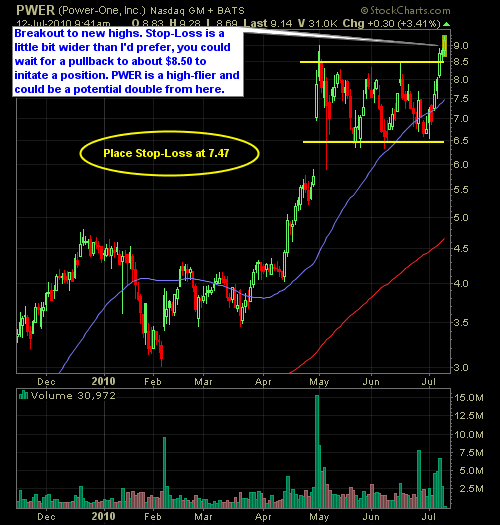

Market is trying to move higher again right out of the gates, with the NASDAQ leading the way. We’ll see how it holds up. Here’s some trade setups for you this morning. LONG: Power-One (PWER)

Not the greatest week for the bears by any stretch of the imagination. I am however, thankful that the week was only four days long. Transaction-wise it was my busiest week of the year. I was stopped out of two positions, while initiating four others. The positions I was stopped out of were Hilltop (HTH)

What a wild week we had! Started the first two days taking back some of the losses from prior weeks, and while the market was dead on Wednesday, on Thursday, we got such strong-downside action, the likes of which we haven’t seen in quite some time. Then to cap it off, the market looks like

Wow! What a month we had in the markets. It is now done and over with and February is right around the corner. On the week, all the indices finished down with the Nasdaq being the worst of them down 2.63%, followed by the S&P down 1.64%, and finally the down down 1.04%. It

The first week of the year is in the books, and by many standards the most important week. I really have no opinion on the matter, I approach every week the same, namely, to attempt to make the value of my portfolio at the end of one week more than what I started the week