June 6, 2008

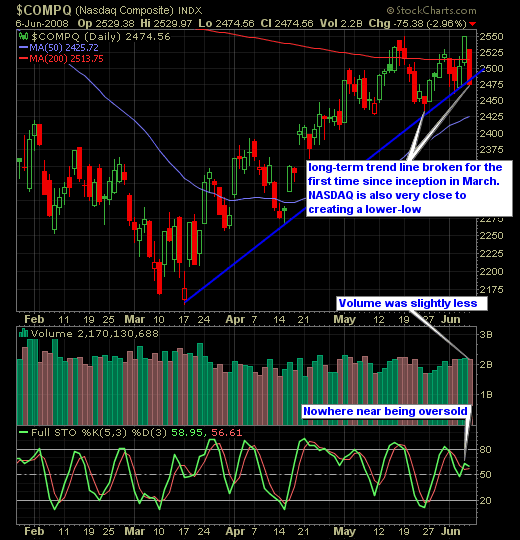

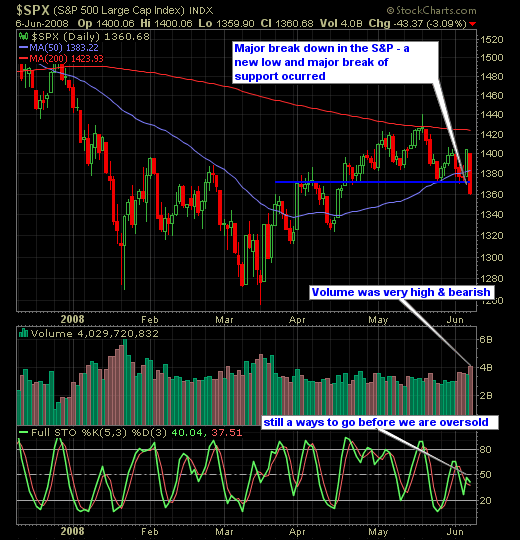

For most of you out there, today was a terrifying day and rightly so with oil spiking higher than we’ve ever seen, and unemployment data that showed even more people without jobs. While we have managed to stay clear of a recession at this point, we will nonetheless get there if matters don’t improve. In reality, while the jobs data was no good, the market’s biggest impact was oil. Had oil traded flat today, we probably would have been hard pressed to see even a 1% decline. But when you have the biggest one-day move ever in the commodity, the impact will be detrimental to the stock market. The indices are now under a lot of pressure; the NASDAQ, which has been solid to this point, actually, in one day, broke the long-term trend line, while the S&P broke major support and put in a new ‘lower-low’ on the charts. And still, the market is far from being oversold; so more of the same could be in order next week, if oil continues to climb.

As talked about in previous posts, oil has become parabolic in its climb in price. The sell off that we saw over the past couple of weeks was clearly profit taking, and has shown that it is clearly not ready to throw in the towel. Instead it reached new highs today, much of which can be contributed to the report by Morgan Stanley stating that oil would reach $150 a barrel by July 4. So you can throw that firm in the pile with Goldman Sachs as companies who don’t seem to worry about the hysteria that they are creating by making such unnecessary predictions and the impact it has on people’s wallets.

While we are at it, what we are also benefitting from is the years of appeasement to the environmentalist-extremists who have fought to keep oil exploration in the United States at a minimum, so that we could remain dependant for our supplies on terrorist abetting countries. Folks, we need to start drilling, and we need to be energy self-sufficient .

Here’s the NASDAQ and S&P Charts…

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

As swing traders, we have to accept that losing will be a regular part of trading and one that we must accept. In this podcast episode, Ryan explains how a trader who isn't comfortable with losing is a losing trader. If you're not comfortable with losing in the stock market, you'll never find real success as a trader either.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.