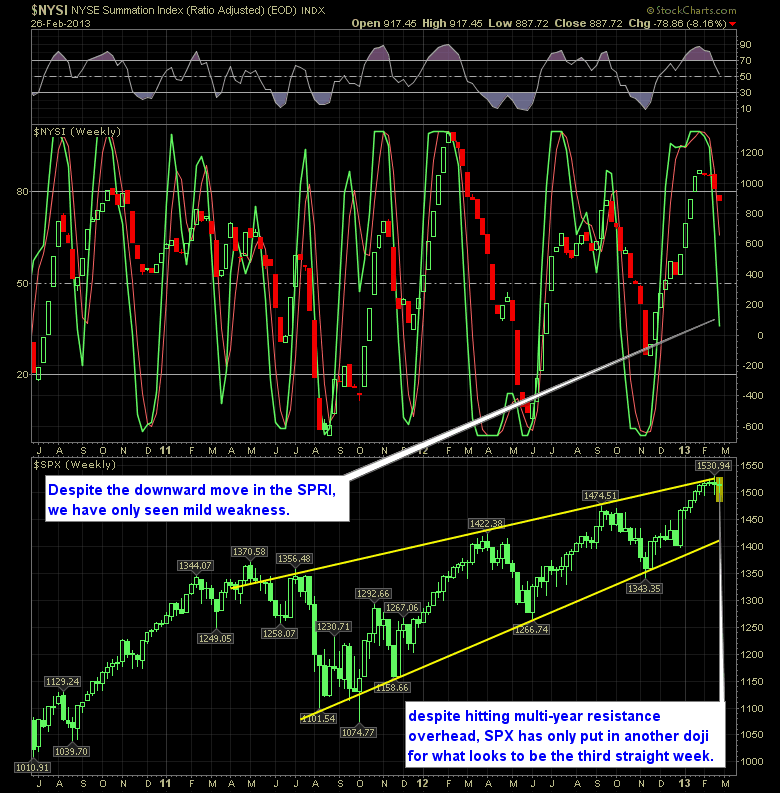

Reversal Indicator points south but the market refuses to reflect the bias.

The Fed has really goofed this market up for the past four years, and since it bottomed out in March of 2009, the stock market has been kept propped up by the Fed’s manipulative tactics of pouring trillions into interest baring assets that drive individuals out of the bond market an into the stocks (a far riskier proposition for those in retirement and forced to do so). Then of course you have vaguely outlined policies of participating in the equities and futures market’s where it is deemed necessary as well. As a result you have a market that continues to rise despite last month’s negative GDP, 8% unemployment, and an economy that has gone no where in years .

Now that I got that off of my shoulders, I’d like to say that despite the weakness we saw on Monday, nearly all of it has been wiped away with the rally we’ve gotten from the last two days of trading. For the third straight week, unless we make a major move between now and Friday, we are looking at closing the week out with another insane doji candle pattern on the weekly chart. My bias still remains to the short side, but barely so.

Here’s the SharePlanner Reversal Indicator

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Each year I like to take a moment to reflect on my swing trading from the prior year. The 2025 trading year offered a lot to be happy about, but it also changed my views in a number of ways and gave me some lessons to take from it, as well as some new perspectives to take into 2026 as I navigate the stock market for yet another year. I'm hoping this moment of reflection in this podcast episode will be as beneficial for you as it was for me in making it.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.