Information received since the Federal Open Market Committee met in August suggests that economic activity has continued to expand at a moderate pace in recent months. Growth in employment has been slow, and the unemployment rate remains elevated. Household spending has continued to advance, but growth in business fixed investment appears to have slowed. The

I took the long-trade in BE Aerospace (BEAV) at $40.75 as I was thrilled to find this gem of a setup with increasing volume levels over the past two days. Expect, once the FOMC statement comes out at 12:30pm eastern, for there to be increased volatility in the market. Traditionally, the Fed tries to provide

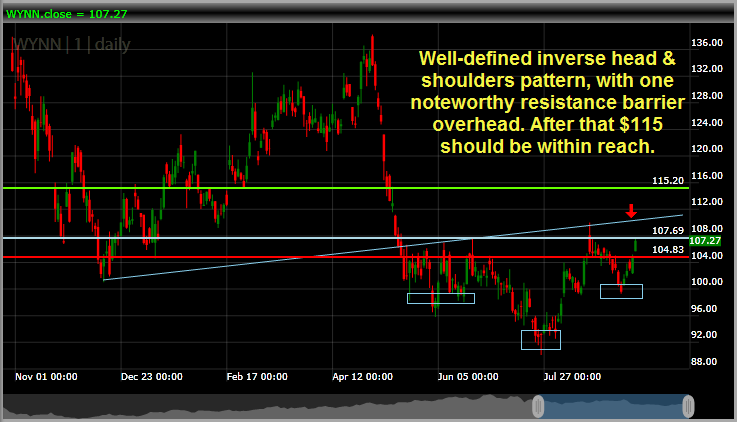

It has been a while since I did some analysis on Wynn Resorts (WYNN) but right now it is in the process of forming an inverse head and shoulders pattern,and the last time I said that, it made some very nice gains for traders. Now WYNN finds itself in similar surroundings yet again, and

First trade of the day, and It looks like it is showing a significant surge of buying power flowing in. Volume is strong, as it was yesterday, and the bull-flag coupled with the successful retest of its short-term uptrend, is important steps for Nielsen Holdings (NLSN) to make a notable move higher. As a result

The Chart of the Day… Not quite a chart, but on a day like today, it is important to remember what we’ve come from and what strongly united us as a country shortly after the horrific events of 9/11. As for myself, I was sitting in a college class at the University of Central

I took my first trade of the day in Carbo Ceramics (CRR) at $72.27. Overall the setup looks solid and is trying to break its down-trend from last March. There is also a very appealing cup and handle formation that has formed and confirmed over the past one-and-a-half months and breaking through notable resistance in

The Chart of the Day… Quick Glance at the Market Heat Map and Industries Notables: Lots of RED in the Financials and Tech sectors. Services and health-care showed glimmers of hope. The afternoon sell-off pretty much took everything down.

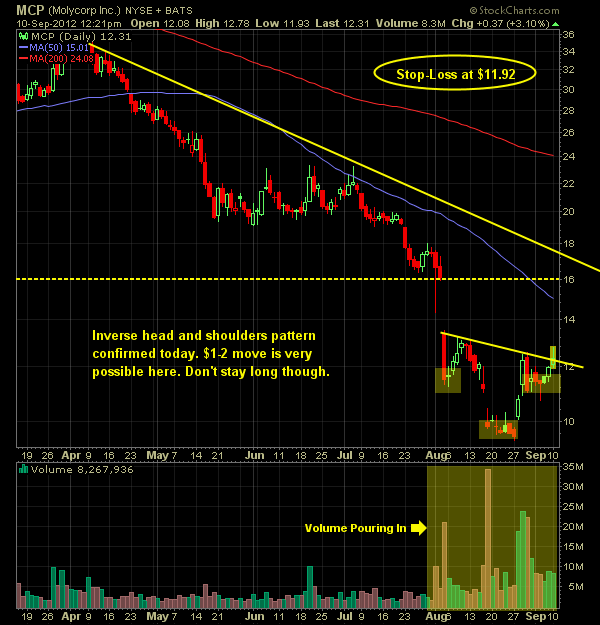

I must have volatility running through my veins today because I just took on two historically very volatile charts and entered into long positions on them both. I jumped in Molycorp (MCP) at $12.48 and then shortly thereafter I got into Alexza Pharmaceuticals (ALXA) at $4.83 – but not to be confused with ALXN which

Pre-market update (updated 8:30am eastern): European markets are trading 0.8% higher. Asian markets finished 2.5% higher. US futures are trading slightly higher ahead of the bell. Economic reports due out (all times are eastern): Employment Situation (8:30am), Treasury STRIPS (3pm) Technical Outlook (SPX): Huge day for the market yesterday – breaking out to 4 year highs

The Chart of the Day… Quick Glance at the Market Heat Map and Industries Notables: Not a good day for the Conglomerates Basic Materials and Tech also weighed down the market today. Services, Goods and Utilities showed a little bit of buying action today.