Hornbeck Offshore Services (HOS) Ready to Breakout Stock: Hornbeck Offshore Services (HOS) Long or Short: Long Entry: $44.92 Stop-Loss: $43.49

Today's Swing-Trade Long Setups: Long: Goldcorp (GG) Long: Hovnanian Enterprises (HOV)

Sarepta Therapeutics (SRPT) Breaking out of long-term consolidation Stock: Sarepta Therapeutics (SRPT) Long or Short: Long Entry: $33.07 Stop-Loss: $31.85

PETsMART (PETM) breaking through long-term resistance Stock: PETsMART (PETM) Long or Short: Short Entry: $62.48 Stop-Loss: $63.75

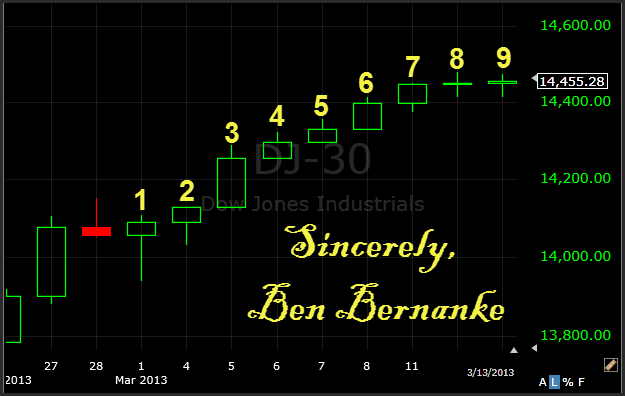

Only in a Fed-induced rally do you go up 9 straight days Quick Glance at the Market Heat Map and Industries Notables: Splotches of weakness in Technology. Services showed a lot of strength after today’s solid retail report. Financials held its own for the most part. Be sure to check out my

Healthsouth (HLS) breaking through long-term resistance Stock: Healthsouth Corp (HLS) Long or Short: Long Entry: 25.00 Stop-Loss: $24.10

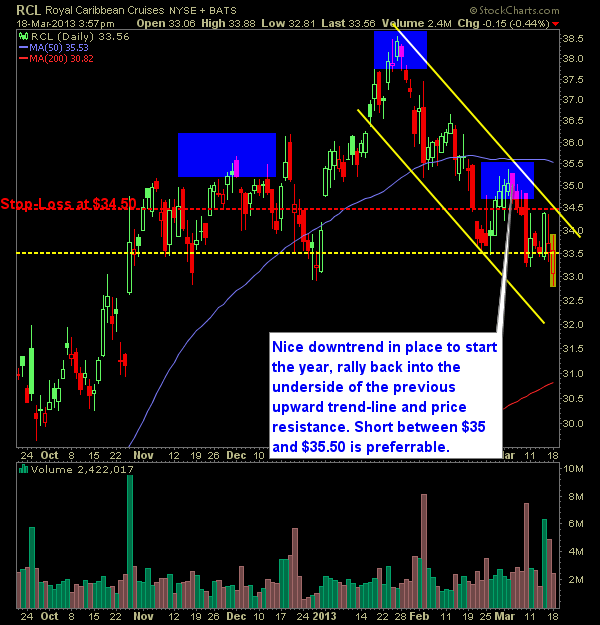

Cautious with the short-setups I’m reluctant to add any new short positions to the portfolio particularly because the dip-buyers continue to prop the market up. Any kind of weakness no matter how big or how small consistently triggers the buying machines and curbs any losses that might have been had otherwise. As a result, I

Alexion Pharmaceuticals (ALXN) Testing Head & Shoulders resistance Stock: Alexion Pharmaceuticals (ALXN) Long or Short: Short Entry: $91.65 Stop-Loss: $93.55

Pre-market update (updated 9am eastern): European markets are brading 0.9% higher. Asian markets traded 1.4% higher. US futures are trading moderately higher ahead of the opening bell. Economic reports due out (all times are eastern): Employment Situation (8:30am), Wholesale Trade (10am) Technical Outlook (SPX): SPX managed to finish higher for the 7th time in