Here’s the full watch-list that I’ll be mainly working from this week. Of course there will be some additions and subtractions throughout the week, but you have my starting point here. There’s a lot of new names and turnover in the list as I removed a lot of stocks, many of which I traded this

There’s a lot of strength in this market in the early going, but the key will be is to let the stock entries come to you. Don’t go after or chase entries in a market like today. Below is today’s list of trade setups to follow and watch-list. LONG: Perfect World (PWRD)

I’ve traded Amazon (AMZN) quite a few times this year with a respectable amount of success. Nothing to get rich off of, but I have captured some gains by trading it to the long side. However, at this point, I’m not really liking what I’m seeing. Its struggling far to much with the $300

Its been a long time since I gave Intel (INTC) much consideration as a trade in either direction. But the setup today is one that I can’t help but pay attention to. First you have a double bottom that has been put in place, followed by a break of the down trend from the

Sometimes a stock that you get sopped out on, isn’t necessarily one worth shelving for the foreseeable future. PDC Energy (PDCE) would fall along those lines I’d suppose. It originally broke out in late August but hasn’t done much since then. It has consolidated nicely just above that breakout level, and if it wasn’t for

The market, if you count today’s progress so far is up 7 straight days. With that being said, it is due for a pullback. Not a big one… just enough to cool itself off some. Somewhere in the range of 7-10 points or so. It is difficult for the market to move more than seven

Pre-market update: Asian markets traded 1.0% higher. European markets are trading 1.1% higher. US futures are trading 0.6% higher ahead of the bell. Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), JOLTS (10) Technical Outlook (SPX): Huge rally yesterday to push the market firmly higher and officially destroying

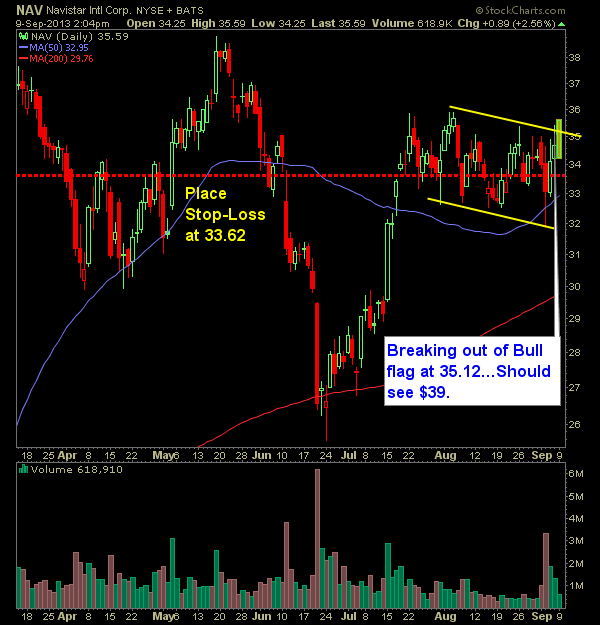

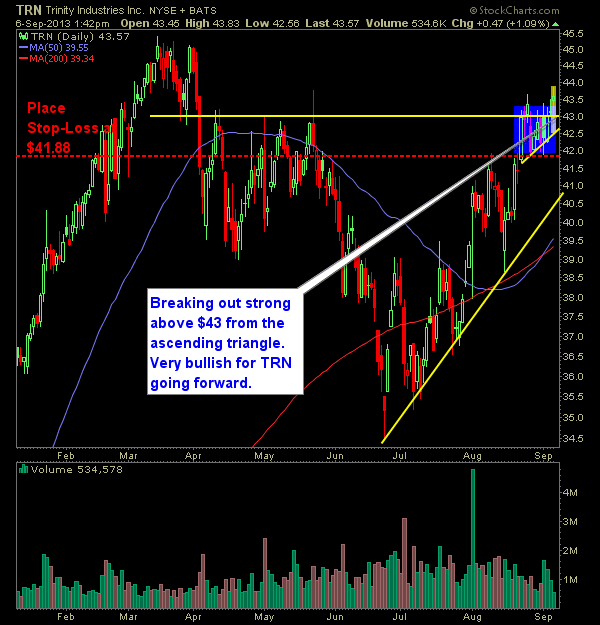

For whatever reason, automotives are running. I don’t concern myself with the catalyst for them running as much as I do with the fact that they are running and from a technical analysis stand point are setting up really nicely for a trade. This could be the beginning of a much bigger rally. I’ve seen

I like this particular chart pattern – essentially you have an assending triangle within an assending triangle and both of them are breaking out at the same extact time. You can’t be that! So get long as close to $43 as you possibly can – once you do that the risk is pretty tight and

Baidu (BIDU) is offering us one heckuva short opportunity. Perfect rounded top with those beautiful golden arches (confession: I got hungry for some McDonalds as I was drawing those arches). The time to get in BIDU as a short is now. As it is just now breaking the neck of support on the stock