I have a couple of trades to report for you this morning. I would have liked to add more to the portfolio, but I’m choosing to be cautious until the non-stop dip-buying ceases. Not to mention we have the FOMC Statement coming out tomorrow, which is also reason to be cautious heading into that news

Here are four charts that I believe make for excellent shorting opportunities at this very moment. The key variable is whether the market will cooperate with these stocks in the process and drive them lower. I would have liked to of pulled the trigger on all four of these right at the market open, but

Here’s my short setups that I’ll be playing the closest attention to as the day wears on. CBL & Associates Properties (CBL) has a head and shoulders pattern along with a significant support level it is trying to break below at $16.69. Allied Nevada Gold (ANV) is another I like, but I want to see

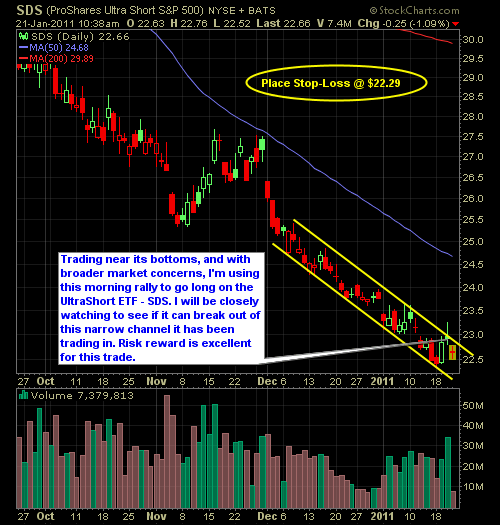

LONG: ProShares UltraShort S&P 500 (SDS) Two new trades to report this morning. If you saw my last post, you’ll notice that I mentioned some resistance overhead that the S&P could be running into. So far, that is exactly what has happened. As a result, I put my capital to work on that theory and

In markets where an unusual amount of selling pressure starts to creep in, it is hard not to find setups that aren’t crumbling to the downward momentum that is prevalent across the board. However, there are four stocks, that are holding up to the selling pressures quite well over the past two days, and should

I’m not willing to say that the lights have been turned out on the bull’s rally parade of late, but I do think they are looking at some major problems here, that they need to soon correct, before the bears are finally resuscitated back to life. In my short positions that I executed this morning,

Market beginning to look a bit toppy in my humble opinion, and with the market in general being quite overbought in every sense of the word, I want to throw out some shorting ideas in the form of stocks waving the bear-flag for a breakdown. Here are 9 Bear-Flag Breakdown Set-Ups.

Two new trades this morning. I actually got in BB&T (BBT) at $27.47 and Brigham Exploration (BEXP) at $28.42 – both breakout plays. LONG: BB&T (BBT)

Two new trades to report this morning. Both were done on the morning weakness, and once it seemed like the initial selling had calmed down some. The first was Schlumberger (SLB) and F5 Networks (FFIV). LONG: Schlumberger (SLB)