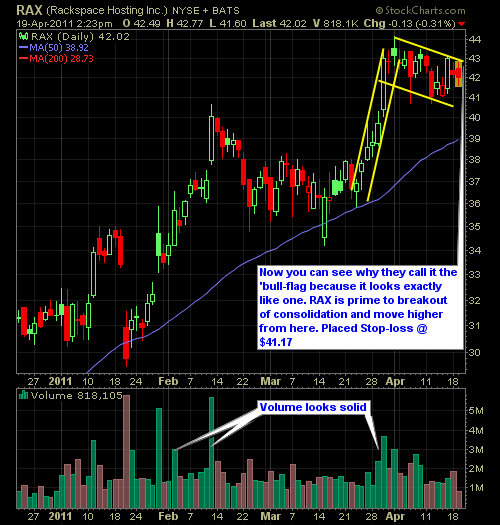

Couple of new stocks that are in play for me today Rackspace Hosting (RAX) at $42.01 and Enzon Pharmaceuticals (ENZN) at $11.07. The latter of which is a good reminder why I tend to deplore swing-trading biotech stocks, as some random news peace happened to come out without notice (as they all do usually) and

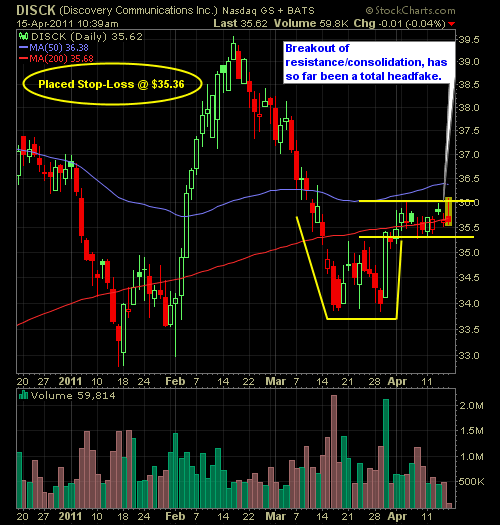

I closed out AMGN this morning at a 2.2% gain at $55.50. I also tightened my stop-loss in GLW to 19.66 to lock in my gains which is just below the day’s lows. My two new trades on the day are CROX and DISCK, which so far haven’t been very kind to me on

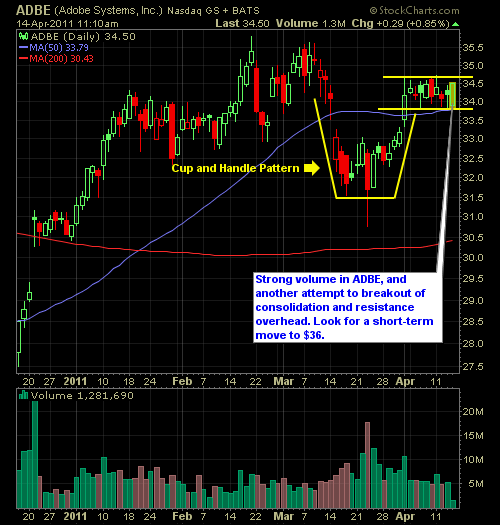

The market has done an admirable job of recovering off of its morning lows. The S&P tested the Fibonacci 38.2% retracement level and held it so far. I’ve jumped into one additional long position this morning – Adobe Systems (ADBE) at $34.40 and a stop-loss at $33.78. LONG: Adobe Systems (ADBE)

The market gave us a nice open, but so far has been a huge disappointment since then. The only positive thing that has taken place so far is that it has reclaimed the 50-day moving average, but even that MA has proved to offer little support/resistance of late. I did add two new trades to

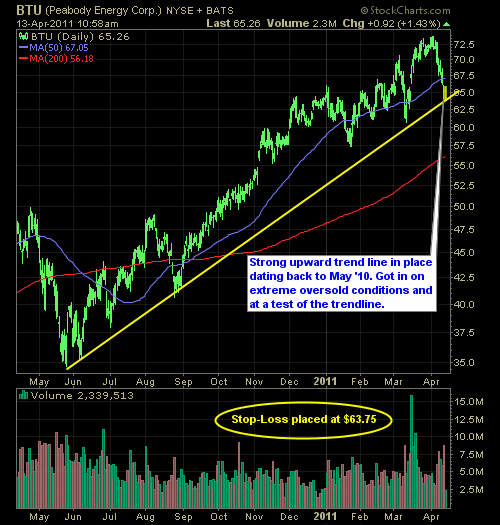

I have two new trades this morning that I jumped into with a tight leash, and while I may be swimming up stream here, I have seen plenty of times since the March ’09 recovery lows, where the market begins to break down and before you know it, rallies in the face of impossibility. The

I’ve Made one new trade so far today, not including my stop-out in Ford (F) at $15.14. I went long Adobe (ADBE) at $34.40. So far so good, if the market can keep from dropping lower today, the stock should continue to progress nicely, particularly if the volume levels we are seeing so far

I took a long position at $18.33 on a nice cup and handle breakout with a stop at $17.97. The market this morning is trying to get back to that 1332 trading range, and seems absolutely magnetized to that number which also represents the previous lower-high.Overall today and for this week as well, the market

Market is trying to shake some traders out of their positions in the early going. Not a lot of direction, but I don’t find that to be reason not to put on descent long setups in trades that have good risk reward setups. I’ve added Silvercorp Metals Inc. (SVM) at $15.05 to the portfolio. I’m

Two new trades, though neither have moved much since getting in to, with the first being in Suncor Energy (SU), which is forming a nice cup and handle.

I’ve made a couple of trades this morning – the first was Brigham Exploration (BEXP) which I was in and out of so fast, that there wasn’t enough time to do a post. The second one was Alcoa (AA) which I went long at $17.25. I expect this to be just an intraday trade, based