After taking profits in all my positions except for Family Dollar (FDO), which included NFLX (+5.3%), GLD (+0.6%), ANV (+1.9%), and CMI (+3.2%), I decided to get into Schlumberger (SLB) at $84.17. I like the trade a lot and has the potential to make a run to $88 in the very

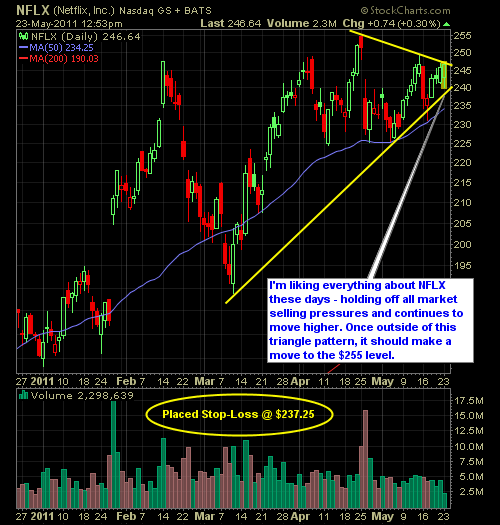

I was a bit hesitant to go long on anything this morning, but finally decided to pull the trigger on Netflix (NFLX) because a) does much better than the field in bear markets b) bouncing off a nice intermediate upward trend-line c) looking to break through resistance above. I also got into SSO on

I went long Silver (SLV) at $34.06, and though it’s not Linkdeln (LNKD), it does have a lot of volaility, and if you followed my chart that I posted earlier this week, you’ll remember that I highlighted the potential for us to see a nice pop out of this commodity. Well, now it is

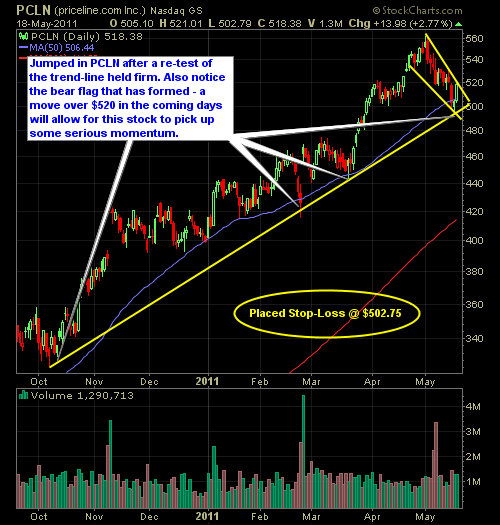

I didn’t get a chance to post this trade as a stand alone article (though I did on the trading ticket for everyone) earlier today, so I wanted to take some time this evening to do exactly that. I believe that this trade is good to take all the way up to $520. After that,

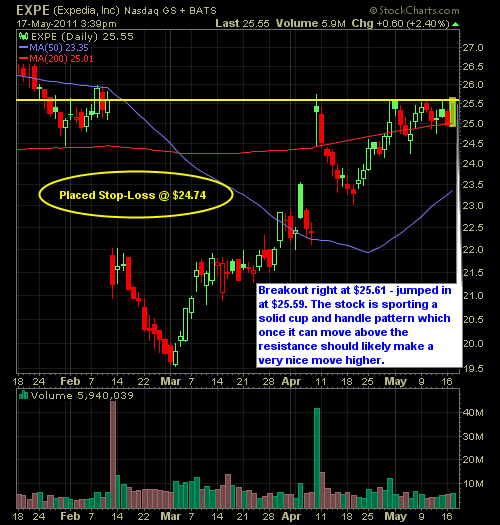

Finally made two late afternoon trades, the first of which is in Expedia (EXPE) at $25.59, and the other in Frontier Communications (FTR) at $8.80. I also managed to get out of the S&P UltraLong 2x (SSO) at $53.60, after having averaged down five times outside of my original buy-in. At one point, at

So far, it appears that commodities are trying to bounce today, and taking with them, the market in sympathy. We are definitely due for a sizable bounce in the short-term, and whether or not it is a dead-cat bounce or legitimate market recovery, it should provide for a nice profit opportunity. This morning I

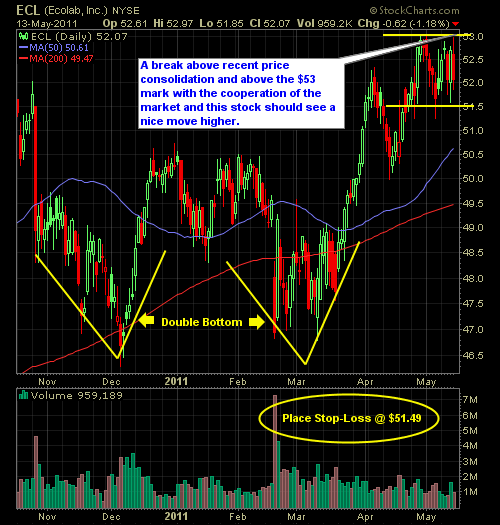

Futures are pointing down, at the moment, but a lot can change between now and the open. Either way, I’ve provided you below with 10 trading setups – 5 of which are to the long side and the other 5 are to the short side. Let’s make it a great week! LONG: Ecolab (ECL) LONG:

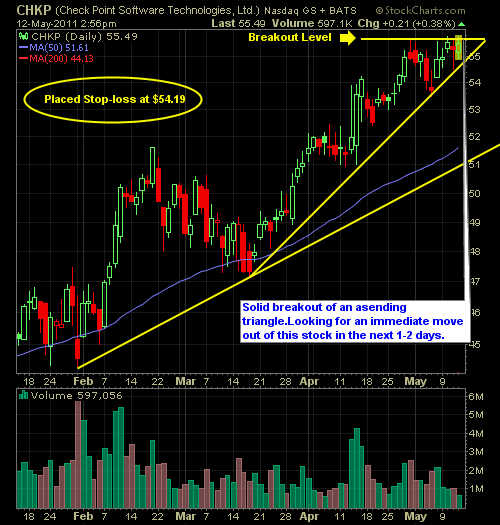

I finally pulled the trigger on two trades this afternoon. The first being in Check Point Software Technologies (CHKP) at $54.19 and the second one being in Constellation Brands (STZ), which was also listed as my daily long setup this morning. I’ll likely be dumping off a few other non-performing positions by the end of

Here are the mark ups on the trades I took this afternoon. Both stocks are valid trades to take tomorrow morning, assuming we continue the bullishness from the past two days. LONG: Hewlett-Packard (HPQ)

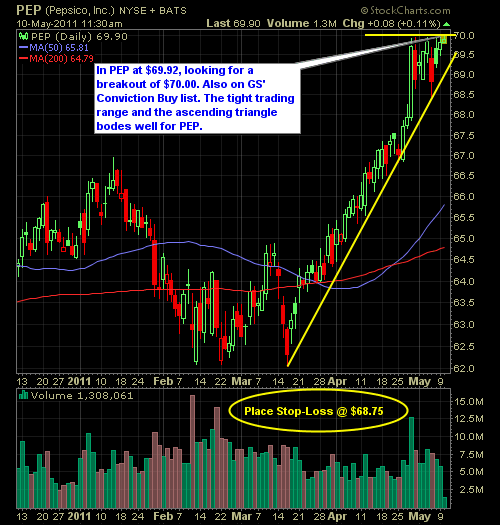

Some activity on my end this morning, buying Pepsico (PEP) at $69.92 (I was actually wanting to get in at $70, but used a limit order instead of a stop – ugh!), and then followed up that buy with another one in Amphenol Corp (APH). I’m still a pretty big fan of tech right now,