Sick of hearing those infomercials about how much of a fool you are for not converting all of your dollars into gold? Or how you could make millions of dollars simply by raiding grandma’s jewelry box and giving it to some hocus-pocus firm that will give you wheel-barrels full of cash for it? I sure as heck am! I’ve heard it from waiters to taxi cab drivers to the bag-boy at the local super-market (in my case it’s Publix) tell me that I should buy gold.

Well how about this! I’m going to short it. I’m going to short gold – GLD to be exact – I’m going to borrow thew waiter’s and the tax cab driver’s gold, sell it to someone else, and then buy it back on the open market and then give it to those suckers who fell for those ridiculous infomercials.

Okay – I might be going a little over the edge there, but there is something gratifying about going against the grain of nearly 50% of the commercials and advertisements out there constantly telling me to buy gold.

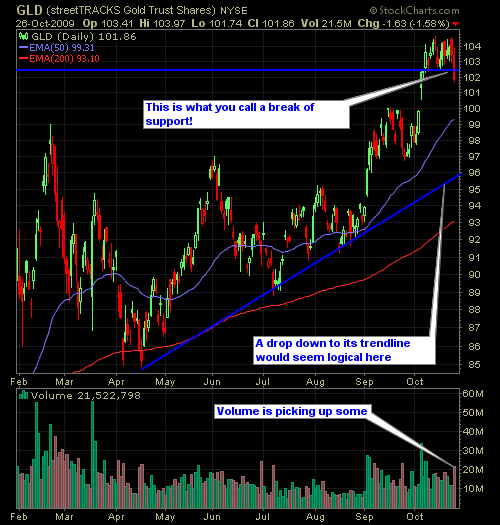

Frankly, the move up in GLD is WAAAAAY overdone, and is primed for a pullback and after today’s action it looks like it is already in the process of breaking down – so let’s join the fun!

Here’s the chart on GLD..

I’d like to get in on strength in the morning, which would allow me to put more of my capital to work, either way I am most definitely not trading in the first 1/2 hour of trading – I’m going to let the action calm down some before staking out my position. Ideally a climb back up to 103 or so would be just perfect, but I might not see that, so I am going to have to play it by ear some tomorrow.

One thing I do know is my stop-loss, and a breakout to new highs would effectively knock me out of the trade.

If your more interested in trading gold using an ultra-short, the one for gold is GLL. Other interesting setups to the short side is anything oil, particularly USO, DUG, and SCO (the latter two are ultra-short ETF’s).

By the way – I held onto my shares in SDS today – the ultra-short of the S&P. I’m going to raise my stop-loss in this holding to protect my profits, and may liquidate half of my position if we get another day of solid downside action.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.