Technical Analysis:

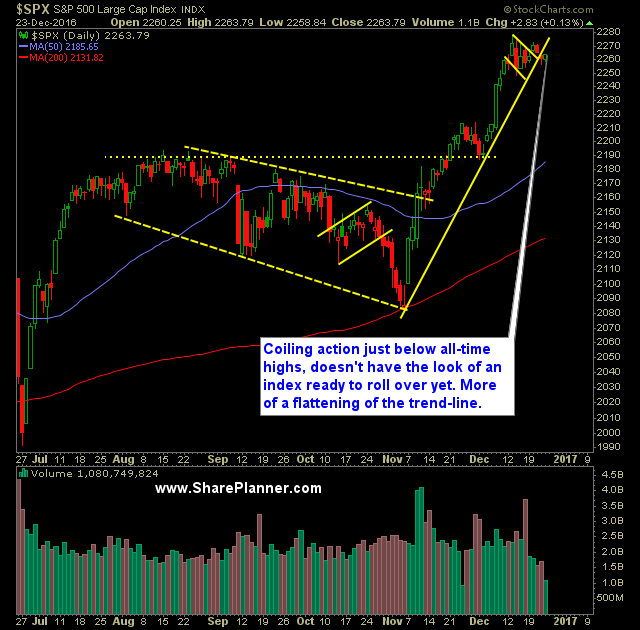

- For the past eleven trading sessions, the S&P 500 (SPX) has traded in a sideways trading range.

- This isn’t unusual for this time of the year as the volume dries up and the big players on Wall Street head to the Hamptons and neglect the market.

- Tomorrow will formally start the Santa Rally, which is the last three days of the year and first two days of the next trading year. Last year though, this time frame was a disaster for the market.

- The day after Christmas (the 26th) has historically been the most likely day to trade higher out of the entire calendar year. That was yesterday and the market was closed yesterday, but I think those statistics apply to the next trading sessions following Christmas, rather than the 26th specifically.

- Traders still anxiously await for Dow Jones Industrial Average (DJIA) 20,000. It is really a meaningless achievement for the market and shouldn’t be seen as anything of significance.

- SPDRs S&P 500 (SPY) had its lowest volume day of the year on Friday – even less than the half day of trading following Thanksgiving, just over a month ago.

- Some lower-highs forming on the 30-minute chart of SPX, but no definitive lower-lows. Trading sideways at this point.

- Light Sweet Oil Futures (/CL) remains in a long-term bullish pattern as it exhibits a solid inverse head and shoulders pattern over the last 15 months.

- For now the market remains very bullish and shows little to no indication it desires to pullback in the near term. Trying to front-run a market top at this juncture is a very futile exercise and should be avoided. Wait for the market to show signs of cracking via price action before getting net short on this market.

- So far the market is basically ignoring the rate increase entirely. There has be no impact so far. Last year, the selling picked up considerably right at the end of the year when the traditional Santa Claus rally typically kicks off.

My Trades:

- I did not add any new positions to the portfolio yesterday.

- I did not close out any positions in the portfolio yesterday.

- I will look to add 1-2 new swing-trades to the portfolio today.

- I am currently 40% Long / 10% Short / 50% Cash

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I talk about tightening the risk on the trades and the benefits of taking a multi-pronged approach in doing so between profit taking and raising the stops. Also, I cover how how aggressive one should be in adding new swing trading positions and how many open positions that one should have at any given time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.