People are hysterical about bitcoin, they’ll become more so when it crashes

One way to know, is when you say something negative about it, they lose their freakin’ minds. They automatically try to attack you personally or your credibility.

I get the cryptocurrencies are hot, but so were tulips. At one point, tulips were so expensive (talking about the 1600’s here) that people were trading 12 acres of land for one stinkin’ tulip!!!

And I’m sure a lot of people have made money in the bitcoin trade, but like flipping houses, most people never know when to stop.

They have to keep playing because the human mindset is to keep going until they get ROYALLY BURNED on it.

Furthermore to the point of flipping houses, success tends to beget greater risk. If you traded $10k of bitcoin and sold it for an additional $10k of profits, then the next time you trade it, you become more confident and more expecting of the same result. As a consequence, risk management becomes less important. Whether it pulls back or keeps rallying, you’ll find yourself getting back in, and instead of trading another $10k, you either do $20k now, or more than likely raise the ante and put together perhaps $50k on the bitcoin trade.

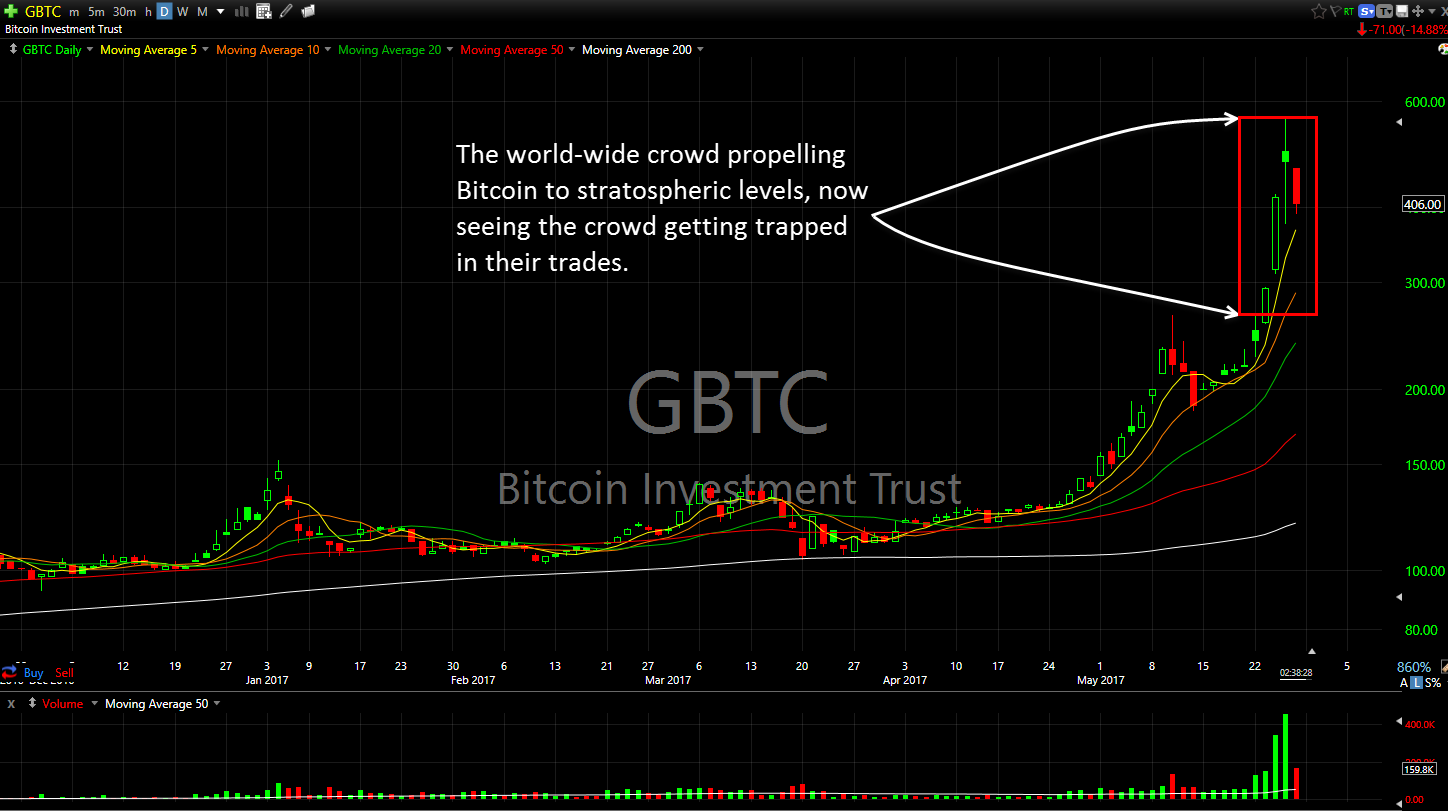

Then you get days like yesterday, where bitcoin is running out of buyers to keep pushing it higher, and as a result the currency starts to crumble at its highs like we see today. And there is a good chance that your cost basis isn’t where the currency was hardly ever talked about prior to the big run, but instead you became important to you once everyone was talking about it and had their own positions to brag about.

If nothing else, just pull up a chart and look at the price action in Bitcoin, and ask yourself whether you really want to be buying the currency when it is this elevated.

I’ll save you the trouble and post the bitcoin chart for you below – Bitcoin Investment Trust (GBTC).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.