Up until late April the market was on one incredible rally. Day after day, week after week, all stocks could do was go up, up, up.

We even saw the market get within 27 points – less than 2% – from establishing new all-time highs. But now, “Sell in May, Go Away” is picking up credence again, and like this time last year, investors and traders alike are left wondering whether the market has peaked for the year.

For the month of May, the market is already down nearly 1%, and based on the head and shoulders pattern, it looks like next week and the weeks ahead could offer up some similar results.

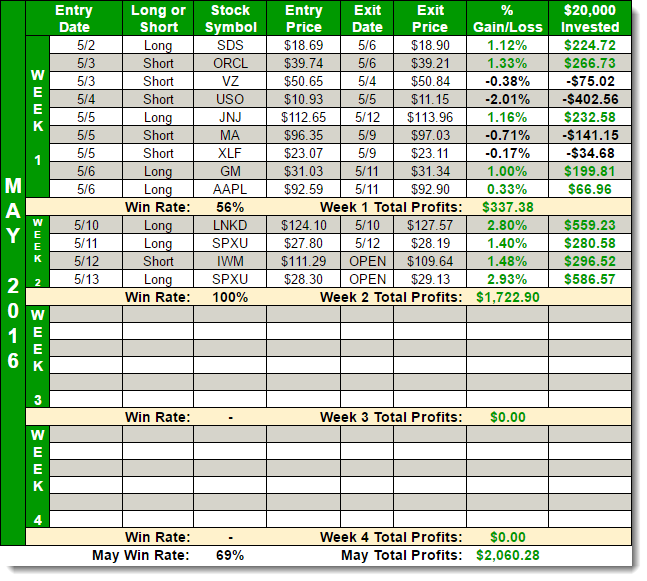

But not so for traders in the SharePlanner Splash Zone who have spent the week again transitioning from long to short in seamless fashion.

Check out the results and decide for yourself how well I am doing:

The market isn’t handing traders profits on a silver platter, but you’ll be hard pressed to find anyone else out there that is doing a better job of profiting consistently in this nothing but inconsistent market.

If you’d like to join me in trading each and every day, you can do so by signing up for a Free 7-Day Trial to the SharePlanner Splash Zone and see for yourself just how great of a product it is.

With your membership, you will get all of my real-time trade alerts via the chatroom as well as through email and text messaging (international traders too).

So sign up and start trading with me, and start profiting no matter the market!

With The Splash Zone, you will get my low risk and high probability trade setups that no other trading service can offer.

Start Your Free 7-Day Trial Today!

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.