Long swing-trading setups that I current have on my watch-list

With all this fiscal cliff discussions hitting the market like we saw yesterday with Harry Reid’s blathering, this market is becoming difficult to get a grasp on. I’m taking gains quickly for the most part and just not willing to risk momentary profits of 3-4% on most of my trades.

With all this fiscal cliff discussions hitting the market like we saw yesterday with Harry Reid’s blathering, this market is becoming difficult to get a grasp on. I’m taking gains quickly for the most part and just not willing to risk momentary profits of 3-4% on most of my trades.

I figure you can expect a lot of back and forth to take place between both sides, and while they may think they are scoring political points they are doing more harm to the financial markets that can’t figure out what we can expect once January 2013 rolls around.

At the moment I see a ton of great short setups that I would like to take as well as a number of great long setups. However, when the market is chopping around like this, it’s ok to take on a position here and there, but to load up to the gills can be hard on the portfolio when the market doesn’t seem able to figure out whether it wants to break through that resistance at 1410 or not.

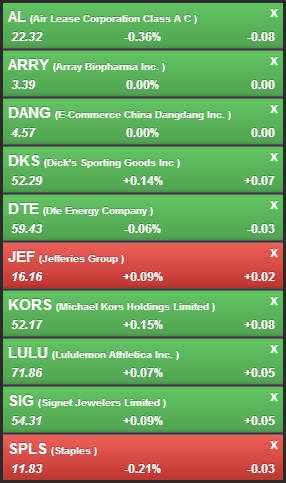

The top swing-trades on the watch-list are:

A few of the stocks that I really like on the right hand side here is China DangDang (DANG) which has broken a long-term downward trend-line and consolidated just above it. My initial thoughts are to make this a day-trade, but the price action may warrant an overnight position in this particular stock. It’s just that risk increases exponentially when doing it with a stock like DANG.

The other stock that seems very favorable to me is Jefferies Group (JEF) at $16.16. There is a lot of support at the 8-day exponential moving average at the moment, and that should carry on as it moves higher.

Right behind them are Array Biopharma (ARRY) and Dick’s Sporting Goods (DKS).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

Passive investing can be a great source of funds for retirement and for building a nest egg. In this podcast episode, a husband and wife asks Ryan's thoughts on building a SPY position on just $2/day. While consistent building a nest egg, is great, the timing and strategy in doing so is just as important.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.