Current Long Positions (stop-losses in parentheses): AGYS (7.60),SPY July 130 Calls, AAPL July 330 Calls, SBGI (9.67), VVTV (7.42), MHLD (7.04)

Current Short Positions (stop-losses in parentheses): None

BIAS: 7% Long

Economic Reports Due Out (Times are EST): MBA Purchase Applications (7am), FHFA House Price Index (10am), EIA Petroleum Status Report (10:30am), FOMC Meeting Announcement (12:30pm), Bernanke Press Conference (2:15pm)

My Observations and What to Expect:

- Futures are slightly down..

- Asia rallied over 1.6%, and Europe is trading flat and mixed.

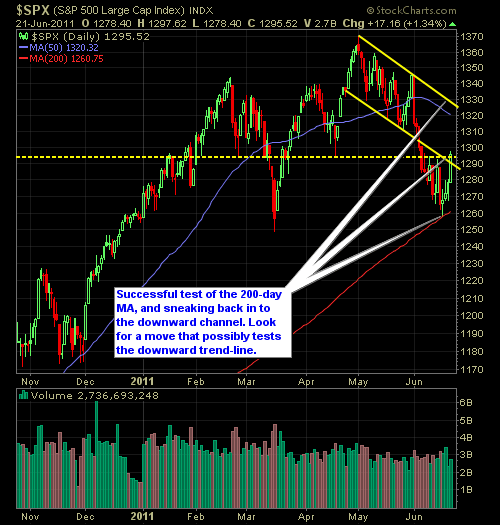

- Yesterday’s rally helped to repair some of the technical damage done over the last 7 weeks.

- We broke convincingly above the resistance at 1293 which represented the highs of the doji candle formed on the weekly S&P last week.

- As it currently stands right now, we are forming a bullish morning star candle pattern over the past 3 weeks on the S&P weekly chart.

- Also important was that the S&P finished above the resistance formed by the 4/18 and 2/24 lows on the S&P.

- Price action also managed to break back into the downward channel that the S&P traded in for all of May.

- Assuming we can break through 1300, the target for the bulls would become the downward trend-line formed off of the 5/2 highs, which currently sees resistance at 1324.

- Volume was slightly higher, but still below average of late, likely due to investors remaining on the sideline ahead of the FOMC.

- Last time the FOMC Statement was released, there was very little reaction to it in the markets.

- Breaks in the 10-day moving average, typically leads to at least a 1-2 day bounce in the markets.

- A break below 1257 or the 200-day moving average would be disastrous for the markets.

- My conclusion: Market has rallied for 4 straight days, and yesterday’s move was very bullish. We could see the bears step in an try to short this rally. Caution is urged at these levels.

Here Are The Actions I Will Be Taking:

- Busy day yesterday, Sold AGYS at $8.35 for a 6.3% gain, VVTV at $7.97 for a 5.7% gain, SBGI at $10.44 for a 4.4% gain, ICOG at $2.90 for a 2.4% loss, IDIX at $5.17 for a 0.4% loss, KKD at $8.82 for a 1.8% loss.

- Held MHLD overnight. Expect this to be a 2-3 day trade.

- Ideally would like to sell my S&P July 130 calls on market strength today.

- Will continue to day-trade the market with my focus being on small cap stocks.

- Follow me in the SharePlanner Chat-Room today for all my live trades and ideas (as well as everyone else’s).

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.