Economic Reports Due out (Times are EST): Empire State Manufacturing Survey (8:30am), Treasury International Capital (9am), Industrial Production (9:15am), Consumer Sentiment (9:55am)

Pre-market Update (Updated 8:30am eastern):

- US futures are slightly higher ahead of the open.

- European markets are trading 1.2% higher.

- Asian markets traded on average -0.6% lower.

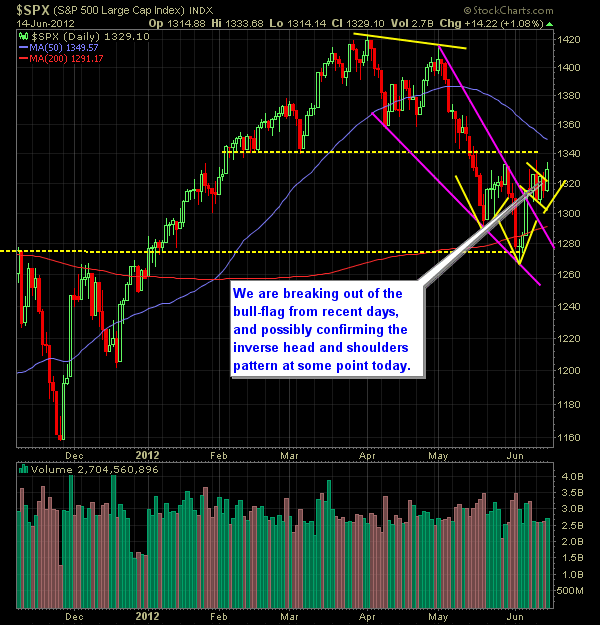

Technical Outlook (SPX):

- Solid day for the bulls yesterday, as price action is finally starting to move out of the 5-day consolidation range.

- To spur on the bulls to additional buying, there needs to be a close above 1334

- Today is options expiration so there is an increased likelihood of volatility in the market (as if we don’t have enough already).

- 50-day moving average could create headwinds for SPX at 1347.

- Continue to follow SPX’s 10-day moving average for short-term support in this market.

- Inverse head and shoulders forming over the past month – currently working on the right shoulder – could see confirmation today.

- IH&S pattern very obvious on the 30-minute chart.

- SPX is no longer overbought.

- Volume remains relatively average.

- The markets in general have pulled back roughly 10% off of its recent highs which is typically considered a “pullback” in the markets.

- A break below 1306 would represent a resumption of the downward trend.

- VIX is still elevated and rests above 21 – below 20 and the bear’s hopes for a break lower is greatly hampered. However, it did take a pretty solid hit yesterday.

My Opinions & Trades:

- I am looking to add more long positions to the portfolio going into today’s open. Conditions are becoming more favorable.

- Careful about trading in and out of this market too much – I’m playing with my original stop-losses which is usually 3-4% off of the entry price and gives me enough wiggle room to weather the choppiness of this market day-to-day.

- Day-traded SDS yesterday and sold at $16.51 from $16.58 for a -0.4% loss.

- Bought PCYC at $40.66 yesterday.

- Currently Long PPL at $27.65.

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.