Economic Reports Due out (Times are EST): Empire State Manufacturing Survey (8:30am)

Premarket Update (Updated 9am eastern):

- Futures are strong on the heels a strong China GDP.

- Asian markets were up from 0.9% up to 3.2%

- Europe is showing positive gains averaging about 1.4%.

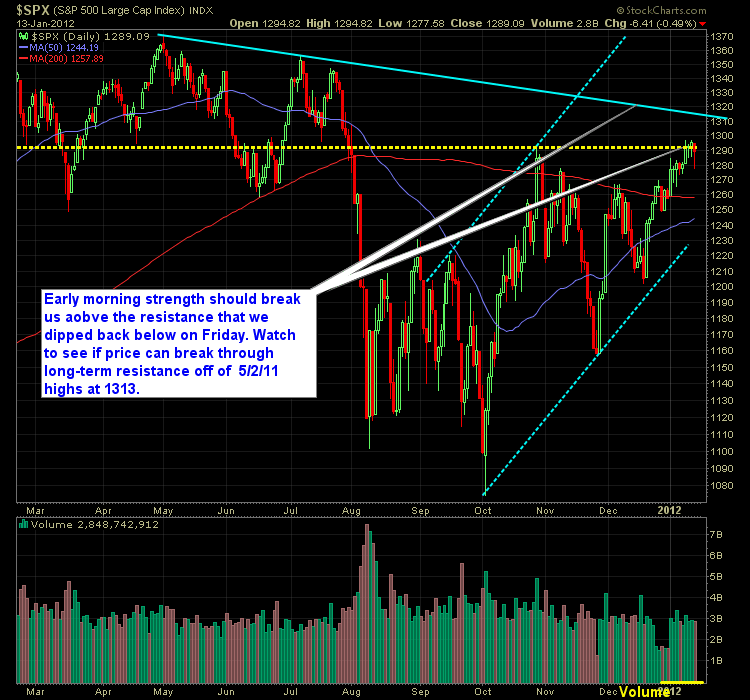

Technical Outlook (S&P):

- Friday’s action saw the S&P sell off nearly 20 points in the early morning, only for the market to spend the rest of the afternoon rallying higher and recovering nearly 3/4 of those losses.

- Over the past 3 months we have rarely had a trending down-day, meaning the market continues to put in lower-lows and lower-highs. Instead, we get a strong push in the morning, followed by a brief basing pattern, and finally a rally in the afternoon that wipes away much of the day’s losses. Remember this going forward.

- Overnight the S&P futures formed a head and shoulders pattern on the 5 minute chart, that could ominously lead to the market giving up some or all of its gains.

- Volume levels still remain flat in comparison to recent weeks. Seasonally it is very low.

- Issues taking place in Europe is gradually creeping back into the economic picture, particularly with the S&P downgrading a number of countries, and threatening to do so with a number of others.

- 1313 is the key level on the S&P for the index to break down and through, as it would technically end the down-trend that we’ve been on since reaching the 5/2/11 highs. 1300 will also be an important psychological level as well.

- Short term support for the S&P lies at 1255, and long-term support off of the October lows lies at around 1228. The market doesn’t appear to be anywhere close to threatening these levels.

- No need to remind you have overbought we are right now.

- Market is up 13 out of the last 17 sessions.

- There still remains unfilled gaps from 11/28, 1/3, and 1/10. The latter two would make it seem likely that we need them to be filled before we can have any substantial move upward.

- On the 30 minute chart we are looking very toppy/distributive

My Opinions:

- At this point I’ll trade higher with the market by focusing mainly on trade setups to the long side.

- Bears would ideally liked to of seen some follow through today, and that is still possible, which would help the bear case out quite a bit if we an finish today in the red.

- Bull runs like this can seemingly go on forever. You have to build your short watch-list and at the same time take advantage of the current upside-strength.

- There seems to be heightened risk going long in this market, at this juncture. Extremely overbought. If you want to get long on this market beyond day-trading, wait for a cooling period first.

- Some divergences occurring with indicators and price, where stochastics and RSI, for example, did not make a move higher with the price action that we saw, showing the potential for a false breakout.

My Portfolio:

- 100% cash.

- I am looking to get more active on the equities side, and not just trade TZA and TNA this week.

- I’ll look to day-trade this market today, and add some swing-trades to the portfolio as well, should the conditions permit.

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.