Economic Reports Due out (Times are EST): MBA Purchase Applications (7am), ICSC-Goldman Store Sales (7:45am), Redbook (8:55am), Existing Home Sales (10am)

Premarket Update (Updated 9:00am eastern):

- US Futures are slightly weaker heading into the open.

- Asian markets traded higher – ranging from 0.3% up to 1.1%

- European markets are trading lower by about -0.5%.

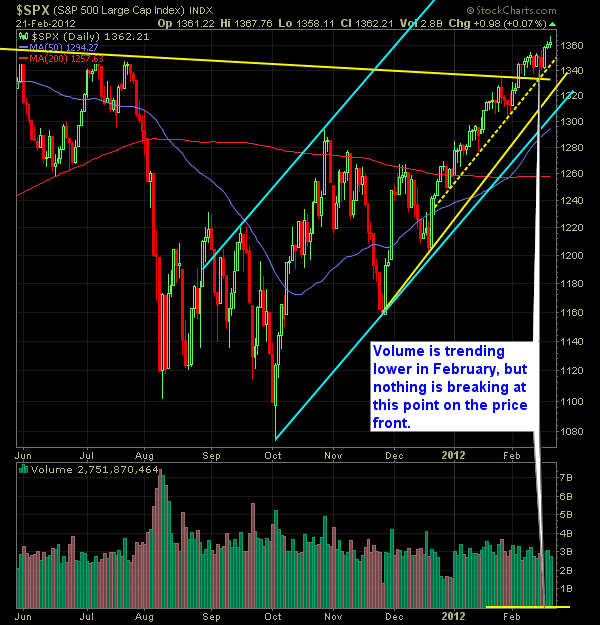

Technical Outlook (S&P):

- S&P formed a spinning top/doji candle stick using a SPY chart.

- All support levels are still held on the S&P

- Volume was light yet again.

- Greece was downgraded by Fitch from “C” to “CCC” with default being considered “Highly Likely” – little material impact to the financial markets though.

- 1370, when looked through the prism of a 15-year chart, represents a very strong price level where markets have historically reversed at.

- The S&P has followed closely to the 10-day moving average since mid-December. However, the two breaks below that have occurred since, have meant very little for the bears.

- The 20-day moving average looks like a very strong rising support level and at 1339, if that price level broke, would represent a dramatic shift in market sentiment.

- We have yet to have a 1% pullback this year – the 13th longest such streak since 1928.

- And yes….We remain firmly in overbought territory.

- Hopefully Greece is behind the market now that they got their “agreement” (but doubt it).

- 30-min chart shows an unwavering uptrend in place.

- Price level support lies at 1326 and then again at 1300. A break of the latter in coming days would drastically change market behavior/outlook.

My Opinions:

- I’m using January-February of last year as my analogue for trading this market – price action is nearly identical, as is the time frames too. With that being said, it is likely we see a pullback of worth here in the very near future.

- Greece was more of a ‘sell-the-news’ event yesterday than anything else.

- Market prices of late have primarily risen on hopes of a Greece bailout. Now that it is out of the way, there will need to be a new catalyst for the markets to take advantage of. So be careful, I would suggest the market is at a crossroads here.

- Rumors continue to drive market hype intraday, don’t be surprised by anything that you see.

- The daily price action, beyond the obvious ‘buy-the-dip” action has been to breakout and move higher, followed by a few days of consolidation and slight pullback. Rinse and repeat.

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.