Economic Reports Due Out (Times are EST): Jobless Claims (8:30am), Bloomberg Consumer Comfort Index (9:45am), ISM Manufacturing Index (10am), Construction Spending (10am), EIA Natural Gas Report (10:30am)

The Breakdown:

- Futures are slightly down heading into the open.

- Asia traded between 1.6% and 5.9% higher, while Europe is trading mixed/flat.

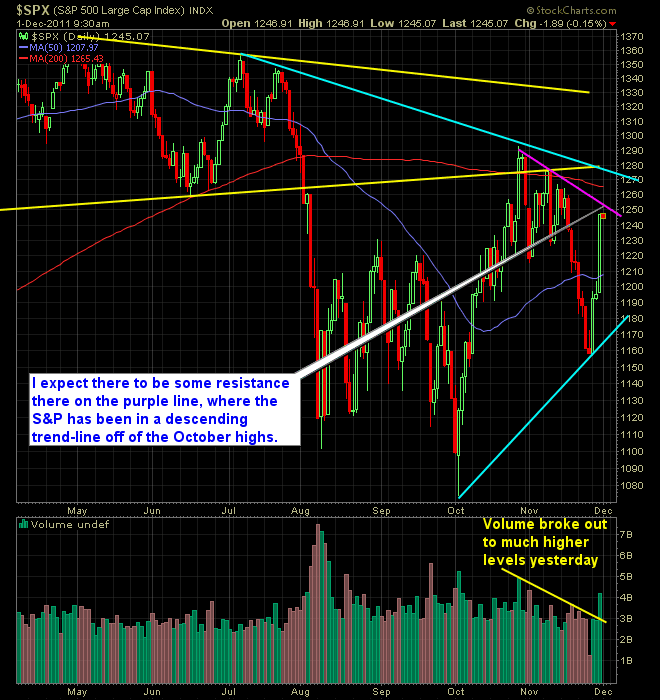

- Yesterday’s volume was the highest that we’ve seen, since the market bottomed on 10/4.

- Volume surges like what we saw yesterday, especially when it practically doubles previous volume readings and averages, can represent looming reversals about to happen in the market.

- At 1250 on the S&P, you have a descending trendline off of the October highs. I expect this to become resistance for the bears today. Breakthrough it, and this market should make a challenge fo the October highs at 1292.

- At 1264 you have the 200-day moving average.

- Support for this market today lies at 1232 on the S&P.

- Yesterday’s move took us above the 10,20 and 50-day moving averages with no resistance at all.

- This is why shorting these market rallies are so dangerous, and why I warned all last week about adding new short positions to the portfolio, because these market rips are so violent and irrational, that it is an absolute capital killer for the bears who don’t go cash beforehand.

- Considering the move that we had on Monday and Wednesday, I would start looking to liquidate some long positions on this incredible strength and over 90 S&P points in 3 days.

- Worth noting as well, is the obvious head and shoulders pattern forming on the weekly chart. Should this be the case, I’d expect then that this market is reaching a short-term top very fast.

- Make sure that whatever you do, that you protect the gains that you have, and be ready for sudden and quick reversals in this market.

- My Conclusion: There is no way to tell how high this market goes, but the volatility is unbelievable. All it takes is for a negative rumor or two to take back this market right back to where it started on Monday, so don’t get too comfortable in your current long positions, and start tightening those stops significantly or taking profits on them.

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I explain whether it is a good idea or not to rapidly increase the size of your portfolio if you come across a sum of cash. A lot of traders will do this without ever recognizing the emotional toll it can have on you as a swing trader and the awful mistakes you can make in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.