Pre-market update (updated 7:30am eastern):

- European markets are trading -0.4% lower.

- Asian markets traded 1.0% higher.

- US futures are trading slightly lower.

Economic reports due out (all times are eastern): International Trade (8:30am), Jobless Claims (8:30am), Wholesale Trade (10am), EIA Natural Gas Report (10:30am)

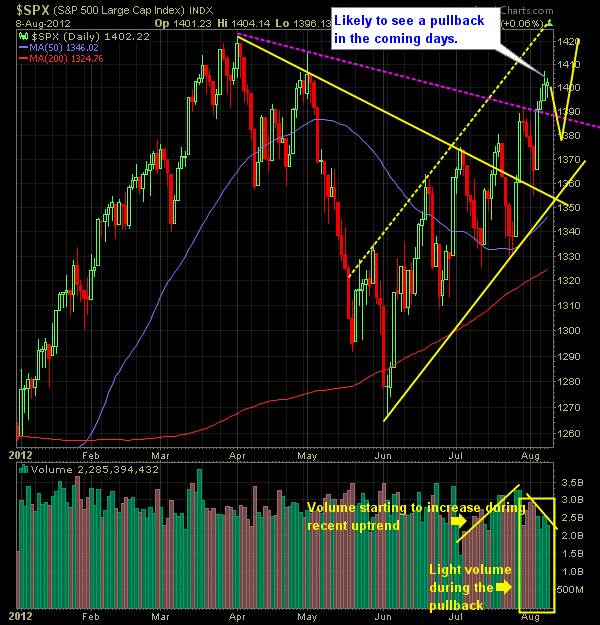

Technical Outlook (SPX):

- Fourth straight day of gains in the SPX.

- Low volume continues to be the norm for the rally over the same time period.

- Market remains well overbought on multiple time frames.

- Solid higher-high with doji-hammer candle yesterday, could be the signal for a pullback here.

- For a while, the rally off of the 6/4 lows looked more like a bear-flag forming, but no longer with the strength in the market over the last month.

- If the SPX is to finish again in the green today, it would be the first 5-day rally since the 3/7-3/12 period from earlier this year.

- SPX poised to make a move to 1422 and challenge the year’s highs.

- Biggest news so far this week, technically, has been the SPX breaking out of the descending trend-line off of the 4/2 highs (as noted below).

- Volume continues to be extraordinarily light over the past few days and if you compare it to this time last year, it is as much as 30% less.

- It’s not uncommon to see large market rallies going into an incumbent re-election – (post later on this today).

- 30min chart is beginning to look like a head and shoulders pattern, which spells trouble for the markets, if the neckline of the pattern confirms.

- If you look at the 4 previous higher-highs in the market since the 6/4 bottom, then one could conclude that we’ve reached another temporary top, and are prime for another pullback.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- At this point, uptrend support rests at 1353.

- SPX trading above all significant moving averages (10,20,50,200).

- VIX had a large reversal yesterday and remains below 16

- If another sell-off were to ensue, watch for a break and close below 1354 for a new lower-low in the market.

- Downside reversal signal still remains intact on the SharePlanner Reversal Indicator.

My Opinions & Trades:

- Sold CNQ yesterday at $30.28 from $28.78 for a 5.2% gainer.

- If the market shows signs of getting top heavy and a possible pullback, I may consider adding 1-2 short positions to hedge my 4 current long positions.

- Market could rally higher at this point, but I’d rather wait for a pullback occur first before increasing my long exposure.

- Remain long RHT at $56.19, AIG at $32.46, MDT at 38.15 and AMZN at $233.90. Short BRO at $25.65

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

What do you do when the best trade setup that you can find is a stock that you already have a position in? Should you trade a stock that you already have a position in and exponentially increase the size of that position? In this podcast episode Ryan explains the circumstances that allows you to increase your position size in an already profitable trade and how to manage the risk in doing so.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.