Pre-market update (updated 9:00am eastern):

- European markets are trading 0.6% higher.

- Asian markets traded 0.7% higher.

- US futures are slightly higher ahead of the bell.

Economic reports due out (all times are eastern): NFIB Small Business Optimism Index (7:30am), ICSC-Goldman Store Sales (7:45am), Producer Price Index (8:30am), Retail Sales (8:30am), Redbook (8:55am), Business Inventories (10am)

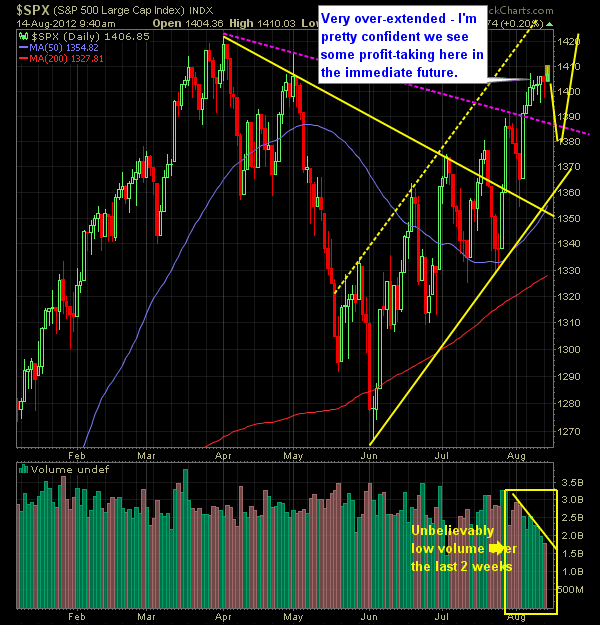

Technical Outlook (SPX):

- S&P finished lower for the first time in seven sessions.

- Volume has become nearly obsolete and in line with holiday like volume. In fact volume has decreased 8 out of the last 9 sessions.

- Such low volume levels leads me to believe that we may be weakening under the surface and that the slightest bit of bad news accompanied with volume will trigger a stop-order raid on the bulls.

- The choppiness that has been a part of the trading action is due in large part to the low volume levels as well.

- We remain well-overbought on all time frames.

- Watch the 10-day moving average for minor support at 1392.

- Next level for bulls to overtake is the 1422 recovery highs on the SPX.

- It’s not uncommon to see large market rallies going into an incumbent re-election.

- If you look at the 4 previous higher-highs in the market since the 6/4 bottom, then one could conclude that we’ve reached another temporary top, and are prime for another pullback.

- One area of concern is the 3 large gaps off of the 6/4 lows that remain unfilled, including 6/6, 7/26, 8/3

- At this point, uptrend support rests at 1356.

- SPX trading above all significant moving averages (10,20,50,200).

- VIX has moved below 15 for the first time since March.

- If another sell-off were to ensue, watch for a break and close below 1354 for a new lower-low in the market.

My Opinions & Trades:

- Closed out position in EL ahead of earnings at $54.95 from 55.07 for a -0.2% loss.

- Shorted COG at $42.01 yesterday. Still holding.

- Closed out RHT at $55.85 from $56.19 for a -0.6% loss.

- Moved my stop-loss in MDT up to $39.61.

- Bought OSK at $23.74.

- Going to consider any sell-off as opportunities to buy stocks on the cheap. Dip buying should be the norm until a lower-low is put in place.

- Remain long OSK at $23.74, AIG at $32.46, MDT at 38.15 and AMZN at $233.90. Short BRO at $25.65, HE at $28.45

Charts:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today’s episode, I talk about how traders can establish their position size for a small account. Whether it be less than a thousand or a little bit more, Ryan provides practical guidelines for determining how you can trade multiple positions and the right mindset to have to put yourself in the best position for success.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.