Economic Reports Due out (Times are EST): Challenger Job-Cut Report (7:30am), Jobless Claims (8:30am), Bloomberg Consumer Comfort Index (9:45am), EIA Natural Gas Report (10:30am), Treasury STRIPS (3pm)

Premarket Update (Updated 9:00am eastern):

- US futures are moderately lower.

- Asian markets traded -0.6% lower.

- European markets are seeing losses of about -0.8%.

Technical Outlook (S&P):

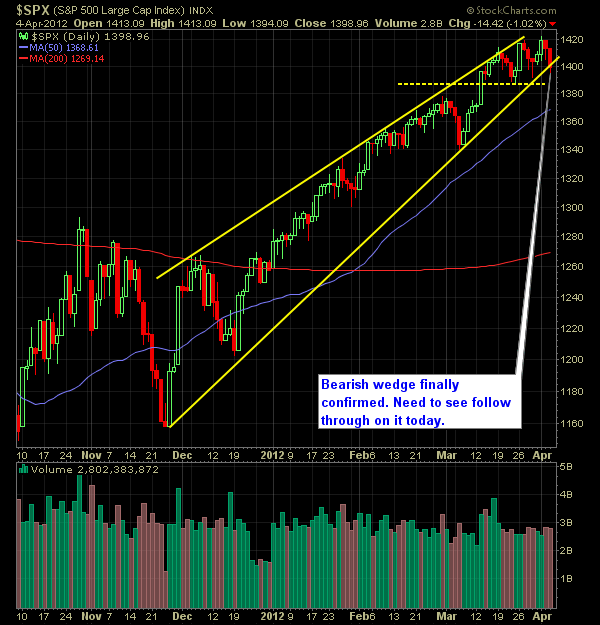

- The sell-off yesterday saw price drop below the 10-day moving average on the S&P and break the trend-line that started off of the December lows.

- Most important about breaking the trend-line off of the December lows is that it confirmed the bearish wedge pattern that we’ve been tracking for well over a month now.

- While the intraday strength might be impressive, the bears are unable on nearly every one of their ‘down-days’ to avoid the late day buying that tends to cut losses significantly. Yesterday wasn’t as significant as most other days. But we did manage to double bottom in the afternoon and pop 7 points into the close.

- Two additional price levels that I’m watching is whether we can break below 1391 and then again at 1386 – both would represent notable shifts in market sentiment – a close below these levels is what you should be watching for. There should be a good opportunity for testing those levels.

- This pullback is acting very similar (so far) to the one we saw last week after making new recovery highs. Though the selling this week has accelerated more.

- The strength of the current trend, while it is still holding on, looks weakened, as its progression higher is becoming more volatile and susceptible to weakness.

- Throughout the rally since December, mild pullbacks have usually been in the form of 3-4 days of selling with notable dip buying occurring throughout (note the long lower candle shadows throughout the selling days).

- Intermediate and long-term time frames are all very overbought still.

- One thing that is very concerning to me is the fact that we have about 3 gaps, dating back to 3/6 that have yet to be filled by the markets. Yesterday we filled the 3/27 gap perfectly before bouncing.

- 30-minute chart hasn’t quite broken down yet – but it is getting very close to doing so, depending on today’s weakness.

- One major concern for equities is the % of stocks that continue to trade below its 40-day moving average and that continues to drop daily.

- Price-level resistance can be found at 1419 and then 1428.

My Opinions:

- I have a number of short positions right now that I’ve been holding on to – I’m likely to begin taking off some of those positions today.

- Still one of the best trades out there is to buy any weakness in the afternoon and benefit from the bounce.

- In this particular market, I’m not overly confident that we can extend losses beyond four straight days. Three days tends to be the norm. I can always reload later.

- I need to see a strong down-day where we close at the lows of the day, before I start to gain any confidence in the short-term bearish prospects of this market or that we might actually be rolling over.

- This is one of the strangest markets that I’ve seen, because traditional indicators of market reversals or signs showing it being overheated are basically worthless right now. Euro dropping has been irrelevant, market negatives have been inconsequential. Much of the rally is in conjunction with favorable Fed policy that continues to allow for this eye-shattering rally. Which hasn’t that really been the case since March ’09?

- From a greater macro view, a lot of bulls getting pulled off of the sidelines, and a lot of people are becoming over confident (though none of them ever realize this) which is usually a time you want to be nervous about being too aggressive to the long-side.

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.