Economic Reports Due out (Times are EST): Jobless Claims (8:30am), Chicago Fed National Activity Index (8:30am), Pending Home Sales (10am), EIA Natural Gas Report (10:30am), Kansas City Fed Manufacturing Index (11am)

Premarket Update (Updated 9:00am eastern):

- US futures are showing a slight amount of weakness ahead of the bell.

- Asian markets traded 0.4% higher.

- European markets are trading in a mixed/flat manner.

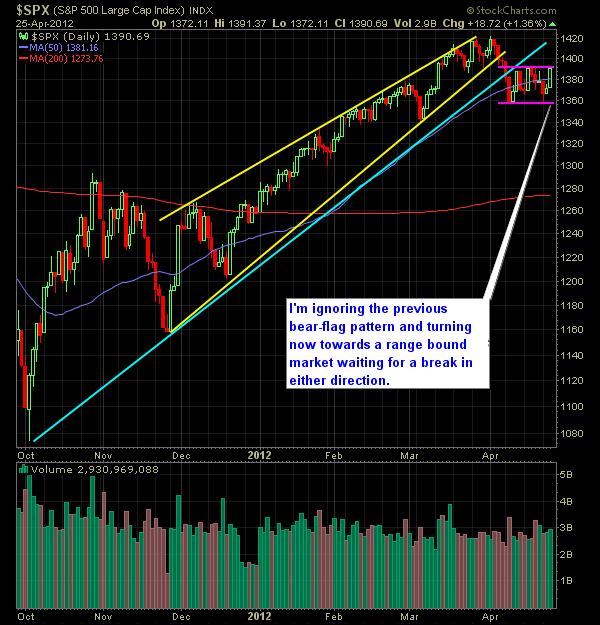

Technical Outlook (S&P):

- Yesterday’s rally came close to wiping out the bearish tune the market had been singing.

- 1392 was the key mark for the bulls to get passed, but couldn’t do it. As a result the S&P is range bound between 1392 and 1357.

- Within this range the market is essentially a boat without its sails.

- Established direction will come when the S&P can break below 1357 (bearish) or above 1391 (bullish).

- The 10, 20, and 50-day moving averages were reclaimed by the bulls.

- Break 1357, the next price level of support is 1340. Break 1392 and it becomes 1401.

- A lot of talk about the ominous head and shoulders pattern on the S&P since mid-February. We are currently forming the right shoulder.

- The previous trend-line off of the October lows has become resistance for price action on the underside.

- On the weekly chart, we confirmed the bearish wedge pattern that we had been following for weeks. Very bearish development for the market.

- We now only have 1 gap remaining from 3/6 to be filled, not counting the huge gap from yesterday.

My Opinions:

- Range bound market leaves me without any significant leanings. I’ll still trade lightly within this range, but will wait for the range bound market to either breakout or breakdown before piling on new positions.

- I sold GOOG at $608.71 from $692 for a 2.8% gain.

- I am still holding short RL from $168.21

- I am neutral on this market until we break out of its range.

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.