Economic Reports Due out (Times are EST): International Trade (8:30am), Jobless Claims (8:30am), Producer Price Index (8:30am), EIA Natural Gas Report (10:30am)

Premarket Update (Updated 9:00am eastern):

- US futures are flat ahead of the market open.

- Asian markets traded about 0.7% higher.

- European markets are trading about 0.3% higher.

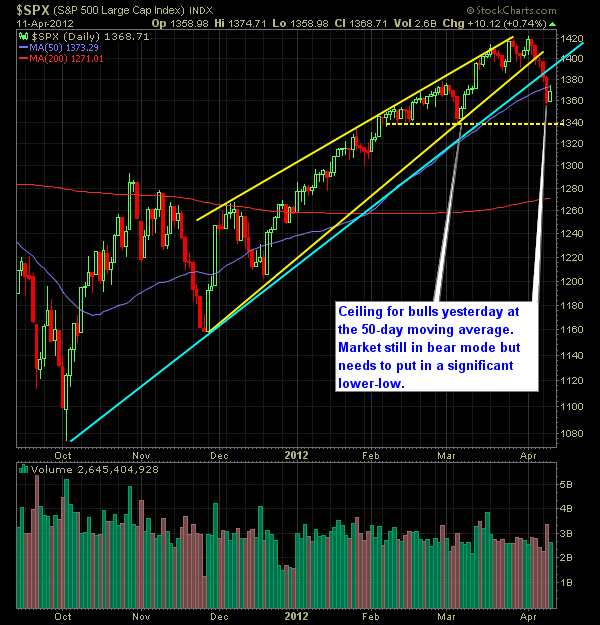

Technical Outlook (S&P):

- Yesterday materialized the dead-cat bounce that we were expecting, but tapered off in the final hours of trading.

- Tested the underside of the 50-day moving average yesterday (resistance) and failed to break through.

- 30-minute chart shows a bull flag on the S&P.

- In order to rebound this market, the S&P needs to push back above 1375 and ultimately 1393, where a descent amount of price resistance exists.

- Short-term the market remains well oversold.

- The trend-line off of the October lows was broken.

- Price broke down below price consolidation at previous highs, and in the coming days and weeks ahead could get down to 1340.

- One thing that is very concerning to me is the fact that we have about 3 gaps, dating back to 3/6 that have yet to be filled by the markets. We now only have 1 gap remaining from 3/6

- One major concern for equities is the % of stocks that continue to trade below its 40-day moving average and that continues to drop daily.

My Opinions:

- I think we are simply in a dead-cat bounce mode right now, and with today’s jobless claims miss, could resume the downward slide in equities.

- Sold SHPGY yesterday for a -3.8% loss at $92.75 from $96.41, Sold my bounce plays in JCP at $34.39 from $33.95 and WLT $61.01 from $58.19 for a 1.3% gain and 4.9% gain respectively.

- Shorted APD yesterday at $87.84 and SWFT at $10.65 – both swing trades and held overnight.

- I expect to add additional short positions today, and potentially a long position as well.

- Biggest obstacle for the bears will be trying to keep the dip buyers from taking advantage of recent weakness, particularly since there hasn’t been a pullback since December – this is their first opportunity to load back up.

- This is one of the strangest markets that I’ve seen, because traditional indicators of market reversals or signs showing it being overheated are basically worthless right now. Euro dropping has been irrelevant, market negatives have been inconsequential. Much of the rally is in conjunction with favorable Fed policy that continues to allow for this eye-shattering rally. Which hasn’t that really been the case since March ’09?

Chart:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.