Pre-market update:

- Asian markets traded 0.8% lower.

- European markets traded 1.3% lower.

- US futures are trading 0.2% lower.

Economic reports due out (all times are eastern): Pending Home Sales Index (10), Dallas Fed Manufacturing Survey (10:30)

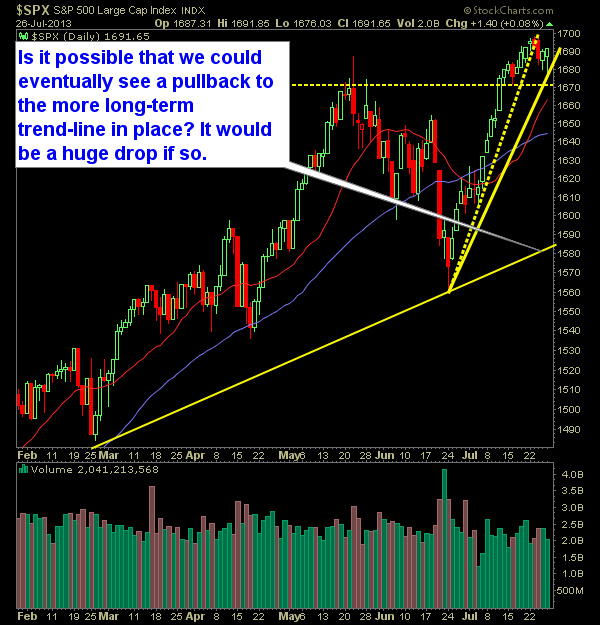

Technical Outlook (SPX):

- After a nasty gap lower, the SPX rallied 15 points to finish slightly in the green for the day.

- Last two trading sessions we have see the dip buyers flood the market and stabilize matters.

- Essentially, the market has been consolidating since 7/12 between 1672 and 1698.

- Throughout the entire month, the SPX seen extremely light volume levels.

- The entire month of July the SPX has traded above the 10-day moving average which is a huge testament to the strength of this market.

- With the consolidation at the highs, I think it is only a matter of time before we break the 1700 price level .

- Considering the dip-buying of the past two trading sessions, I have little confidence that the light morning weakness we are seeing will hold throughout the day .Better than average chance, that the slight weakness gets bought.

- Interestingly enough, the SPX seems to also be finding support at the 1587ish level which represents the previous highs that the market reached back on 5/22.

- 30 minute chart breaks the downtrend that was in place with a nice higher-high.

- If we see any significant amount of selling today, you will want to watch the 1671-2 level as a significant short-term support level. Break below it, and you likely have a much heavier sell-off at hand.

- Pay no attention right now that the market is over-extended. Such conditions rarely matters with the Fed's involvement in the markets.

- VIX dropped with the market's rise and is at 12.72

- This uptrend looks nearly the same as the one we saw on 4/19 and lasted until 5/19. I'm curious if it will lead to a similar extended pullback as a result.

- Markets don't care about the economy. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Added APO at 26.86 on Friday.

- Sold SOHU at 69.73 due to earnings today at 2.7% gain.

- Closed MENT at 20.15 for a 1.9% loss.

- Closed WU at 16.99 for a 2.6% loss.

- Current Longs: ASML at 89.63, RCI at 40.65, HRB at 30.19, SJM at 104.63, BDX at 99.98, GOOG at 887.47

- May look to take gains in stocks that are stagnant and replace them with better setups today.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, at episode 500, I am diving into the lessons learned from trading over the last 100 episodes, because as traders we are evolving and always attempting to improve our skillset. So here is to episode 500, and to another 500 episodes of learning and developing as swing traders in the stock market!

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.