Technical Outlook:

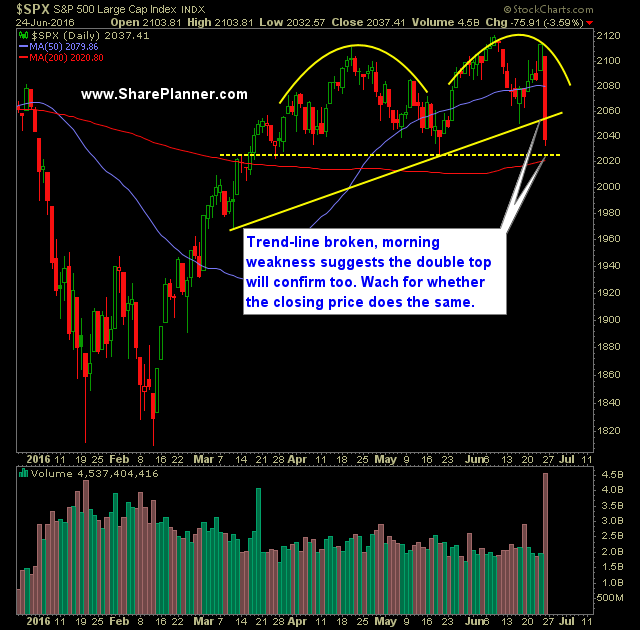

- To say that Friday was an epic market would be an understatement. Following the Brexit news, SPX dropped a cool 3.6% and looks to continue lower again today.

- Here is what you have to be careful of here – central banks. The Central banks will not want this market to continue its drop and will start intervening at some point to provide a bottom for stocks. Expect at some point this week, to see some shock headlines to drive the market back up.

- VIX saw one of its biggest moves ever, rising 49% to 25.76.

- Volume on SPY was the highest reading of the year, and the highest since 8/25/15, when the market was selling off ferociously.

- T2108 (% of stocks trading above their 40-day moving average) dropped more than 42% on Friday, all the way down to 40.2%.

- SPX 30 minute chart is an absolute mess and pretty much dysfunctional. However, a move below 2025 would really help the bears.

- A test of the 200-day moving average will likely happen today which will be around 2021.

- This is a difficult trading environment because there is a lot of headline risk. Don’t force trades, let the trades develop and come to you. Be weary of v-shaped bounces on intraday charts. Look for solid bases to form if you desire to play the bounce.

- Biggest issue for the time being for the bears is that the Brexit vote to leave, may not generate a ton of additional headlines and there is no guarantee, that the politicians, who are against such a move, would even allow it to happen.

My Trades:

- Day-Traded SPY for a 0.9% profit.

- Added profits to the portfolio – I didn’t lose any capital.

- No other transactions on Friday.

- I stayed 100% cash over the weekend.

- Don’t be surprised, in response to a central bank, for a hard bounce to happen this week.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, I cover the expectations that we should be setting for ourselves as swing traders, from the number of trades we should be expecting to take, how long and how short we should be in our trading portfolio, as well as what the expectations for a win-rate should be.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.