Pre-market update:

- Asian markets traded 0.1% higher.

- European markets are trading 0.6% lower.

- US futures are trading 0.4% higher ahead of the market open.

Economic reports due out (all times are eastern): ICSC-Goldman Store Sales (7:45), Redbook (8:55), ISM Non-Manufacturing Index (10)

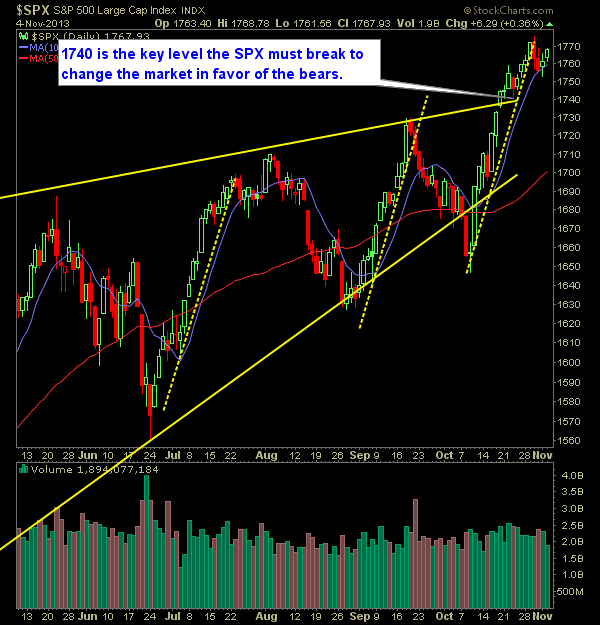

Technical Outlook (SPX):

- SPX continues its bounce off of the 10-day moving average yesterday.

- More weakness than what we are accustomed to seeing in the futures prior to the market open today. Traditionally, SPX has a difficult time holding the gap down, and instead it often times leads to a bounce higher towards breakeven.

- Today’s weakness could provide a good opportunity to add new long positions to their portfolio.

- Volume yesterday fell off dramatically.

- It is shaping up to where we are trading in a consolidated pattern since 10/25 with a range of 1752 and 1775.

- It’s a strong indication that this market still wants to move higher in the coming days.

- SPX actually trying to come off of overbought market conditions.

- If the bears are going to control this market, it needs to take out the 1740 level.

- Markets don’t care about the economy nor earnings. That is not what is driving them. The markets only care about what the Fed is doing to keep equities propped up.

My Opinions & Trades:

- Did not close out any positions on Monday.

- Added GES yesterday at 31.55

- Currently 20% long / 80% cash.

- Current Longs: ALKS at 35.49, GES at 31.55.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today's episode, it swing trading really worth it when you have a full-time job and does it make sense to spend the time and resources towards becoming a successful trader when you already are working that 9-5 job that doesn't really let you focus on the stock market each day? Ryan will cover how he traded when he was in the corporate world, and the strategies that one can use to allow you to find success in the stock market, even when working full-time.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.