Pre-market update:

- Asian markets traded 0.4% lower.

- European markets are trading 0.4% lower.

- US futures are trading 0.8% higher ahead of the market open.

Economic reports due out (all times are eastern): Challenger Job Cut Report (7:30), International Trade (8:30), Jobless Claims (8:30), Productivity and Costs (8:30), EIA Natural Gas Report (10:30),

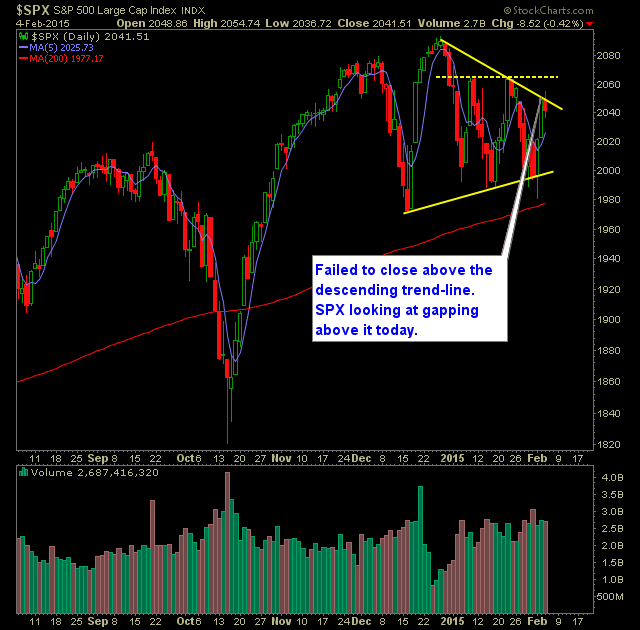

Technical Outlook (SPX):

- A promising day yesterday was wiped out in the final minutes of trading with negative news between the ECB and Greece hitting the wire.

- This created a panic sell that saw good trades quickly go negative.

- Today SPX has rebounded nicely and looking at gapping above the descending trend-line as marketed below.

- Despite trading above it yesterday, the trend line ultimately rejected price at the closing bell.

- VIX rose 5.8% to 18.32.

- The market remains very fickly and yesterday’s late day sell-off was a great example of how the algos and HFT’s are reacting to market news without even considering its content. Just a bunch of automatic sell orders that come online when news hits the air waves.

- Today’s early morning strength is huge, after getting the kind of selling late yesterday. It shows that the bulls are still buying the dip in this market.

- SPX needs to make it a point in the coming days to get past 2064 – a key price resistance level.

- Volume was below average yesterday.

- Oil remains extremely volatile and becoming more so each and every day. Very difficult to trade as are the oil stocks.

- The market doesn’t care about the economy nor earnings. That is not what is driving it. The market only cares about what the Fed is doing to keep equities propped up.

My Trades:

- Added one new position yesterday.

- Sold DLTR yesterday at $75.12 for a 5.4% gain.

- Sold LO yesterday at $66.05 for a 0.4% loss.

- Will consider adding one possible new position as well as tightening the stop-losses on existing profitable positions.

- 30% Long / 70% cash.

- Remain Long: UPRO at 121.81, NFLX at 448.95.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

AI is quickly overtaking our everyday life, and in the process changing how we live our life too. But how does AI impact swing trading and what can we use AI for in order to better enhance our trading returns, and perhaps make it a little bit easier too? In this podcast episode, I cover how AI is impacting swing traders, and what it means for the stock market going forward.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.