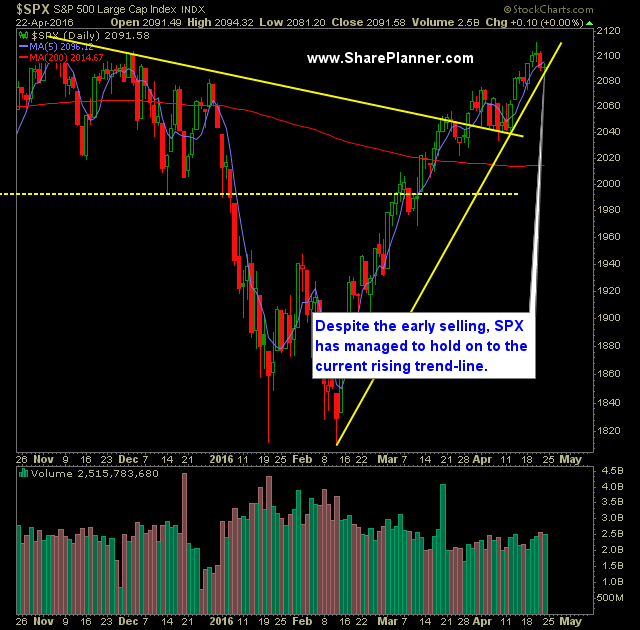

Technical Outlook:

- SPX almost had two days of consecutive selling. Instead in managed to rebound in afternoon trading and actually finish in the green.

- The last lat time the market saw two consecutive days of selling was on April 5th.

- SPX tested the 10-day moving average, held on, and rallied thereafter.

- QQQ, for the better part of 4 weeks has been stuck in a trading range. A drop below last week’s lows could jump start the acceleration to the downside.

- SPX has closed above the previous week’s lows for 10 straight weeks. The record is 13 weeks – as you can see, we are in some rare air here, and the likelihood that it persists isn’t very favorable.

- A break below 2073 on SPX would end the streak.

- There was relative weakness in the VIX yesterday despite the weakness in Nasdaq. Needs to stay above 13 today.

- USO failed to breakout and above recent highs, instead retracing much of Friday’s gains.

- SPX still has a set of higher-highs and higher-lows. But must guard against breaking 2073 in order to keep the current trend in place.

- Heavy news week – Amazon and Apple report earnings, to name a few, followed by Central Banking meetings from the Federal Reserve and Bank of Japan. Finally you have GDP on Thursday.

- Volume on SPY ticked higher on Friday and came in at recent averages.

- It is very important to be aware of the potential for a strong pullback here and to manage your long position risk accordingly.

- April has been bullish in nine of the last ten years.

- Yellen’s dovish outlook as it pertains to rate hikes has been, in large part, the reason for the massive rally off of the February lows.

My Trades:

- Closed out SPXU at $27.55 on Friday for a 0.2% gain.

- Did not add any new trades on Friday. .

- Currently 20% Short / 80% Cash

- Remain short QQQ at $110.40, USO at $10.72.

- Should the market finally start to give up some of its recent gains, I will look to add more short exposure. Otherwise, I’ll have to follow the current trend.

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

In today’s episode, I talk about the merits of trading just one stock and the potential hazards it poses and why it leaves you looking for “a trade setup” rather than “the trade setup”.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

My Website: https://shareplanner.com

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

X: https://x.com/shareplanner

INSTAGRAM: https://instagram.com/shareplanner

FACEBOOK: https://facebook.com/shareplanner

STOCKTWITS: https://stocktwits.com/shareplanner

TikTok: https://tiktok.com/@shareplanner

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.