Technical Outlook:

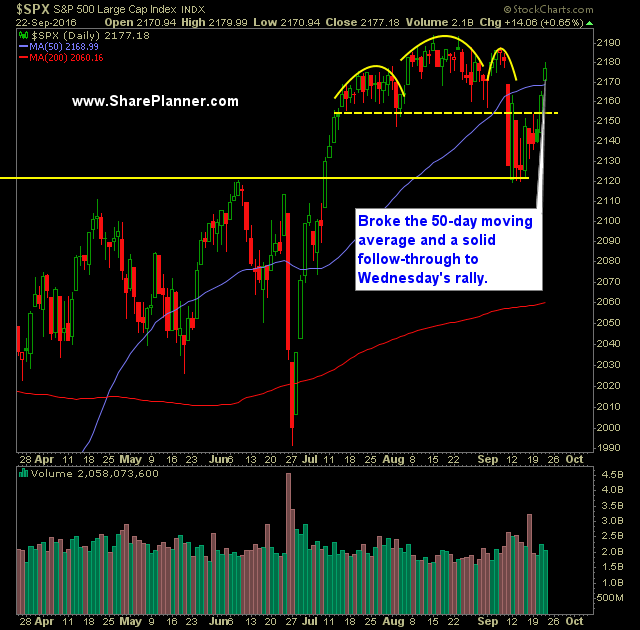

- Strong follow thorugh yesterday on S&P 500 (SPX) that saw momentum come to a halt at the declining resistance off of the all-time highs.

- Yesterday’s rally created a big gap that remains unfilled coming into today.

- SPDRs S&P 500 (SPY) saw its volume drop off yesterday and even come in below recent averages.

- Price action is headed right back towards the chop zone that has plagued SPX for all of July, August, and the beginning of September.

- VIX continues to get decimated. This time dropping 9.5% down to 12.02. The index as a whole has dropped 42% since its highs reached on Monday, September 12th.

- Crude (/CL) continues to rally for a third straight day. but still in a declining channel going back to the August highs.

- SPX 30 minute chart has recently broken out of the recent range that it had been trading through, but now needs to push through the August highs to free itself of the choppiness that has plagued the market for much of the past three months.

- The 50-day moving average was broken yesterday on SPX. A solid mark of improvement for the indices going forward.

- Resistance had been in the area of 2155 to 2170 – that area was broken yesterday. Still more resistance that looms overhead.

- T2108 (% of stocks trading above their 40-day moving average) saw continued bullishness yesterday, rising 23% to close at 56.

My Trades:

- Sold CSX yesterday at 29.63 for a 1.4% profit.

- Added two new long positions to the portfolio yesterday.

- May add 1-2 new swing-trades to the portfolio today.

- Currently 30% Long / 10% Short / 70% Cash

- Join me each day for all my real-time trades and alerts in the SharePlanner Splash Zone

Chart for SPX:

Welcome to Swing Trading the Stock Market Podcast!

I want you to become a better trader, and you know what? You absolutely can!

Commit these three rules to memory and to your trading:

#1: Manage the RISK ALWAYS!

#2: Keep the Losses Small

#3: Do #1 & #2 and the profits will take care of themselves.

That’s right, successful swing-trading is about managing the risk, and with Swing Trading the Stock Market podcast, I encourage you to email me (ryan@shareplanner.com) your questions, and there’s a good chance I’ll make a future podcast out of your stock market related question.

The percentage amount for your stop-losses and where to put them at when trading the stock market can be very difficult to determine. In this podcast episode, Ryan talks about times when it works using tight stop-losses versus very wide stop-losses and the tricks that you can use to narrow the stop-loss even further.

Be sure to check out my Swing-Trading offering through SharePlanner that goes hand-in-hand with my podcast, offering all of the research, charts and technical analysis on the stock market and individual stocks, not to mention my personal watch-lists, reviews and regular updates on the most popular stocks, including the all-important big tech stocks. Check it out now at: https://www.shareplanner.com/premium-plans

📈 START SWING-TRADING WITH ME! 📈

Click here to subscribe: https://shareplanner.com/tradingblock

— — — — — — — — —

💻 STOCK MARKET TRAINING COURSES 💻

Click here for all of my training courses: https://www.shareplanner.com/trading-academy

– The A-Z of the Self-Made Trader –https://www.shareplanner.com/the-a-z-of-the-self-made-trader

– The Winning Watch-List — https://www.shareplanner.com/winning-watchlist

– Patterns to Profits — https://www.shareplanner.com/patterns-to-profits

– Get 1-on-1 Coaching — https://www.shareplanner.com/coaching

— — — — — — — — —

❤️ SUBSCRIBE TO MY YOUTUBE CHANNEL 📺

Click here to subscribe: https://www.youtube.com/shareplanner?sub_confirmation=1

🎧 LISTEN TO MY PODCAST 🎵

Click here to listen to my podcast: https://open.spotify.com/show/5Nn7MhTB9HJSyQ0C6bMKXI

— — — — — — — — —

💰 FREE RESOURCES 💰

— — — — — — — — —

🛠 TOOLS OF THE TRADE 🛠

Software I use (TC2000): https://bit.ly/2HBdnBm

— — — — — — — — —

📱 FOLLOW SHAREPLANNER ON SOCIAL MEDIA 📱

*Disclaimer: Ryan Mallory is not a financial adviser and this podcast is for entertainment purposes only. Consult your financial adviser before making any decisions.